Volatility Profiles of the Most Liquid Currencies (plus NZDUSD and AUDNZD)

Supplementary data included

The most liquid currency in the world is the EURUSD. According to the BIS’s “OTC foreign exchange turnover in April 2022”, it accounts for 22.7% of the total daily turnover in FX. However, it is not the most volatile currency. In fact, there is a weak inverse relationship between liquidity and volatility1, so that the best currencies to trade are the ones with decent but not too high liquidity or vol.

I thought it would make sense to give statistical profiles of such currencies. The chart below shows the 10 most liquid pairs in the world according to the BIS. I didn’t have USDCNY intraday data and I already profiled the EURUSD, so I included NZDUSD and AUDNZD for no good reason other than curiosity. In this post we will go over the expected moves (in pips) by session, by calendar, by weekday and by hour over the years spanning 2011-2020. The figures in the previous post were averages of the entire duration in percentage terms, but in this yearly averages are used.

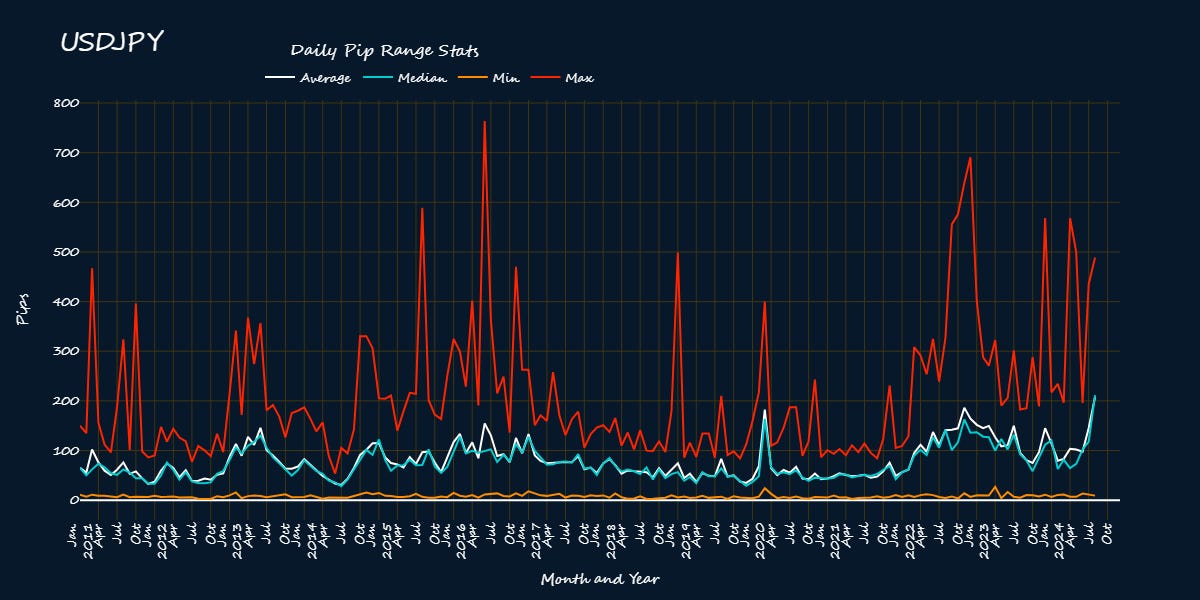

Editor’s note: I don’t like analyses that rely on averages because there is often some information lost. It is better to look at the full distribution, or at least look at the min, max, med, and avg to understand how the distribution looks like. That said I feel like averages work for this study because mins and maxs would be outliers, and the median doesn’t deviate much from the average unless it’s due to an outlier. Also the charts are hard to read. Here’s USDJPY’s stats for each month since 2011.

But, if you really want the other descriptive stats, you can download the data below in excel to do your own analysis.

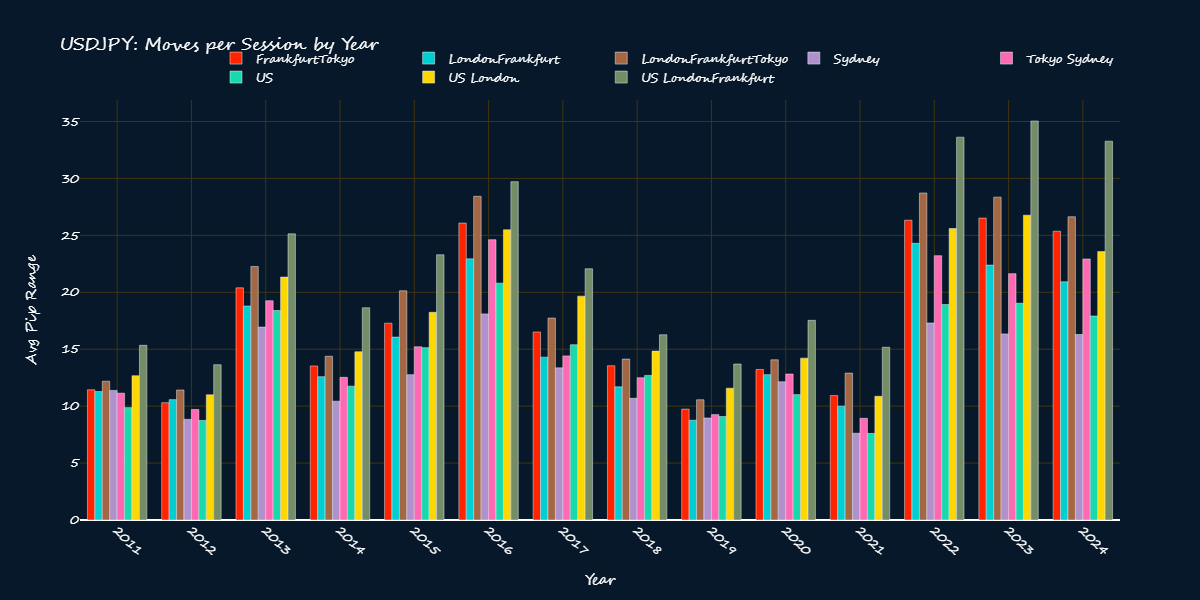

Expected Moves Per Session

Recall that FX trades 24 hours a day starting from Sunday 5pm EST. The trading sessions (in EST) line up as follows:

Sydney: 5pm - 7pm

Sydney/Tokyo overlap: 7pm-2am

Frankfurt/Tokyo overlap: 2am-3am

London/Frankfurt/Tokyo overlap: 3am-4am

London/Frankfurt overlap: 4am-8am

New York/London/Frankfurt: 8am-11pm

New York/London overlap: 11pm-12pm

New York: 12pm - 5pm

The US/EU/London sessions and their overlaps tend to be the most volatile but not for all currencies.

USDJPY’s hourly range per session has increased since 2022 due to the battle between the market and the Japanese MOF. It’s the most volatile currency of the bunch moving by 34 pip each hour of the US/London/Frankfurt overlap.

Cable’s hourly range per session for each session is the lowest it’s been since 2011.

USDCAD moves by the most pips in the US/London/Frankfurt and the US/London sessions. Basically the first few hours of the US session. This year, it moves by 19 pips on average each hour of the US/London/Frankfurt overlap and by 14 pips on average each hour of the the US/London overlap.

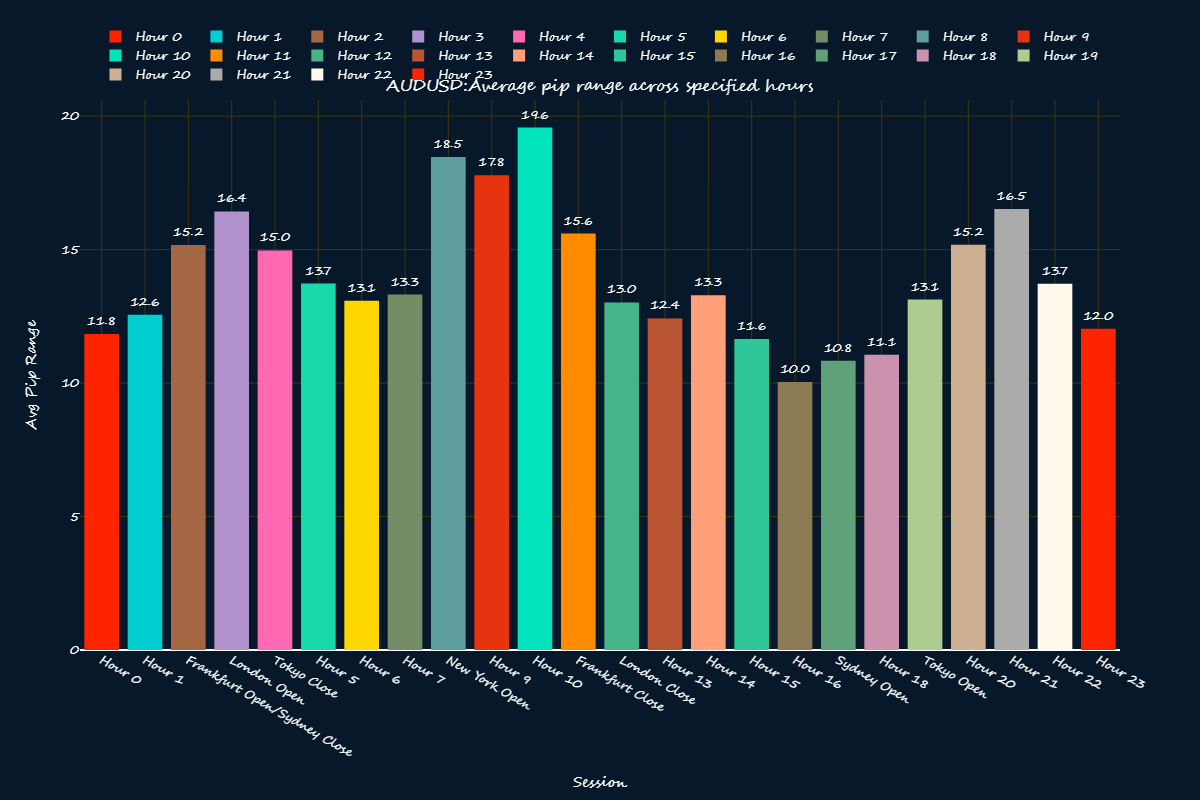

AUDUSD’s hourly range per session is the 2nd lowest since 2011.

EURGBP also has it’s lowest hourly pip range per session this year.

Over the years, the US/London/Frankfurt overlap has become the session when the NZDUSD actually moves. It moves by about 13 pips each hour in that session and then by under 7-9 pips in the other sessions.

AUDNZD also has it’s lowest hourly pip range by session this year. It always moves the most in the Sydney session—about 14 pips each hour this year.

USDHKD has become more and more volatile each session over the years. In 2011, it’s most volatile session was the US/London overlap when it moved by an average of 12 pips per hour, but now it is the Tokyo/Sydney overlap when it moves by the same hourly range.

USDSGD moves the most in the US/London/Frankfurt session by about 13 pip on average each hour.

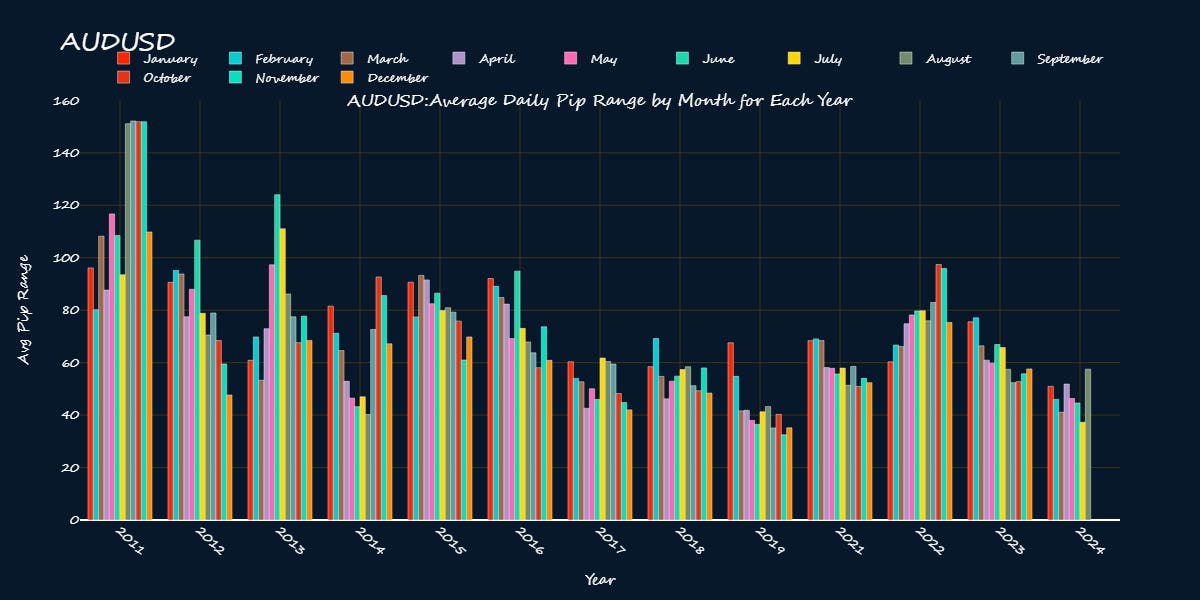

Expected Moves Per Month

USDJPY recorded it’s highest average daily range last month (Aug ‘24).

This year, Cable’s volatility has been quite low compared to other times. It’s average daily range in July was the third lowest since 2011.

USDCAD’s daily range has been low this year and it hasn’t picked up.

AUDUSD’s daily range has also been quite low but it has picked up recording it’s best month this year in August.

USDCHF’s daily range was also quite low picked up in August from 50 pips a day to 80.

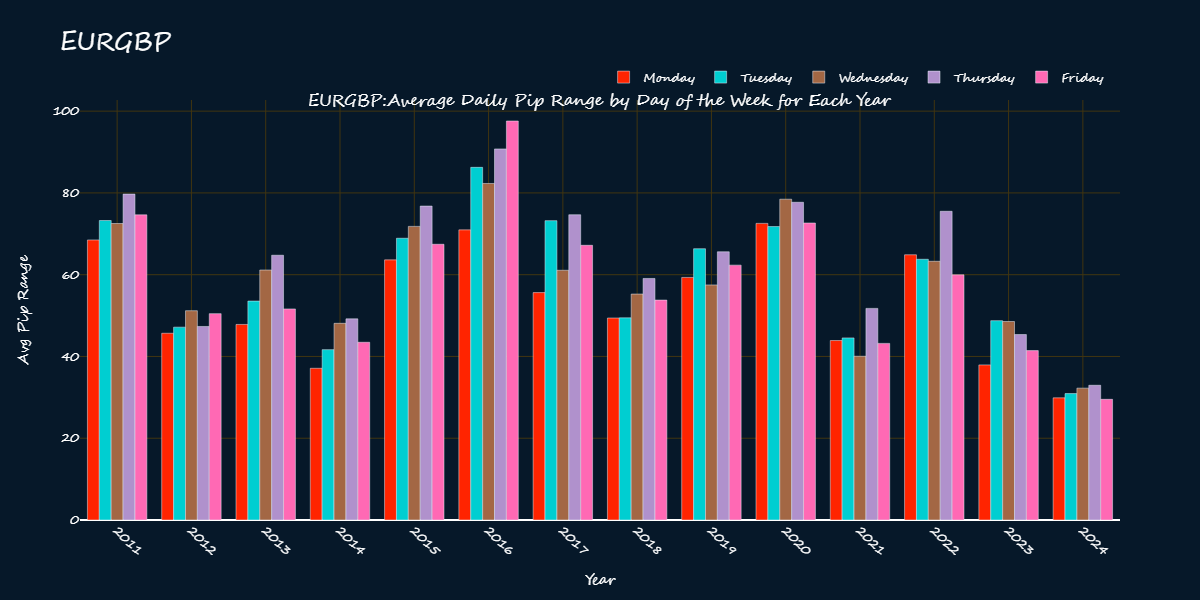

EURGBP recorded it’s worst average daily range in May this year but daily vol picked up in August.

Like it’s fellow antipodean, NZDUSD’s daily range was low this year compared to other years but it picked up in August. The uptick in daily range for both antipodeans is evident in the analogous AUDNZD chart below as well.

USDSGD’s daily range picked up in August.

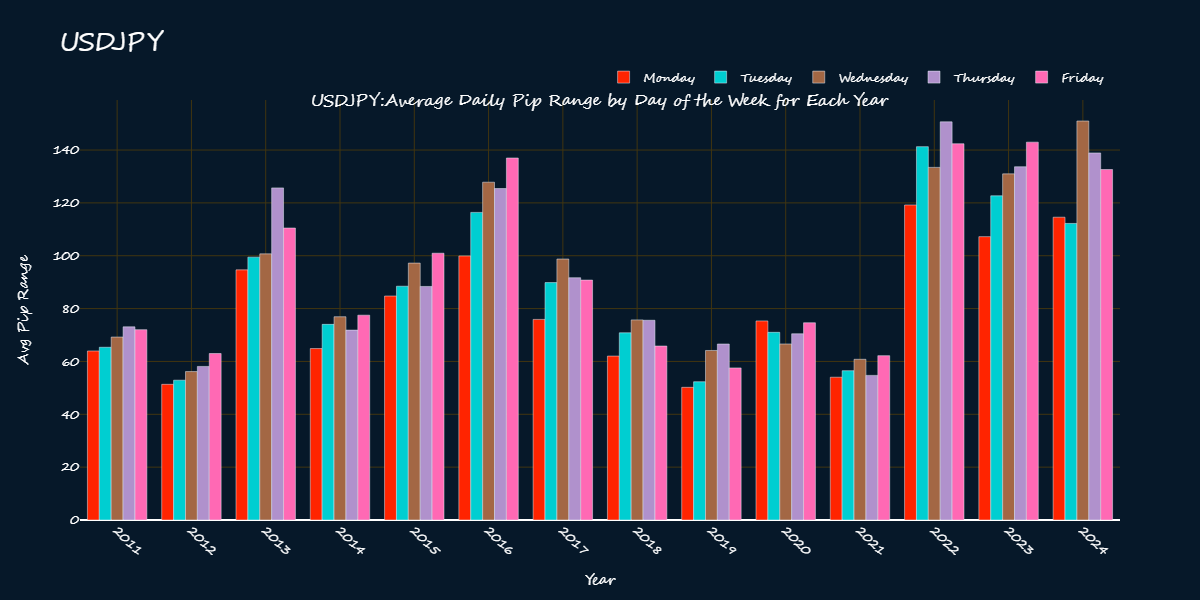

Expected Move by Weekday

This year, USDJPY moves the most on Wednesday’s.

GBPUSD and USDCAD moves the most pips on Friday’s but not by much compared to Tue-Thur.

Wednesday’s are usually good for the AUDUSD.

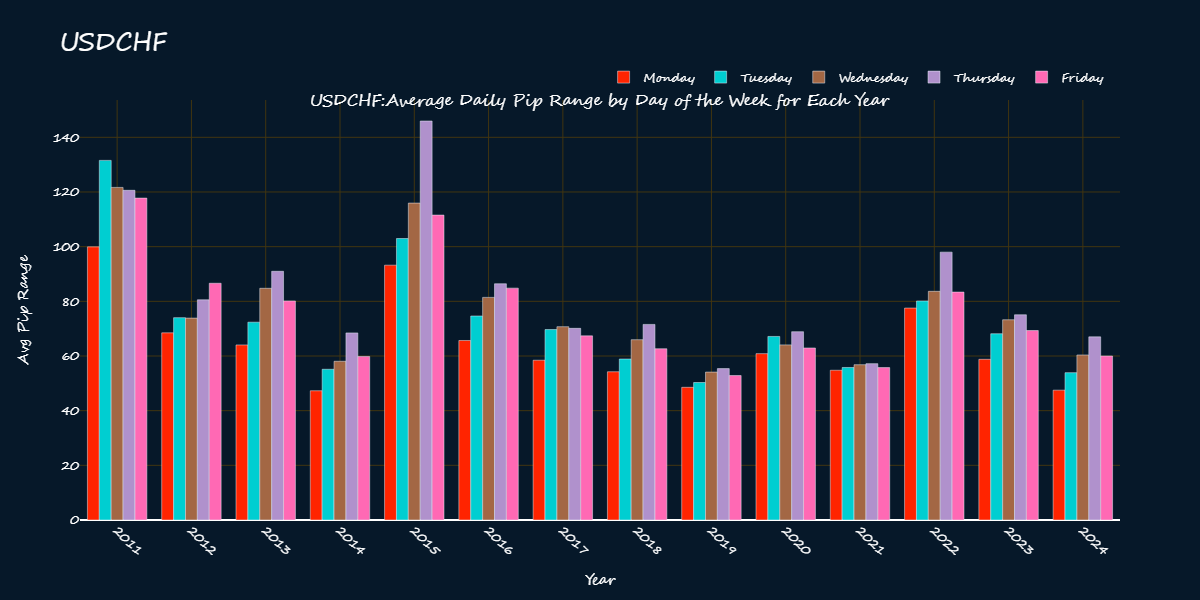

Thursdays tend to be the best day for USDCHF.

EURGBP’s daily range is more of less flat during the week.

NZDUSD tends to move by the most pips on Wednesday.

AUDNZD tends to move by the most pips on Wednesdays.

For the past three years, Monday has been the best day for USDHKD.

Expected Moves by Hour-of-Day

Going back to 2011, the NY open is the most volatile hour of the day for the USDJPY, when it moves by 23 pips on average. The penultimate hour of the EU session is the second most volatile hour of the day for the pair, seeing an average move of 22.6 pips.

The most volatile hour of the day for USDJPY outside the US session is the second hour of the Tokyo when it moves by 18.9 pips. The London open is nearly as volatile, moving 18.7 pips on average.

It is not surprising that the most volatile hours for the USDJPY involve the opening hours of the NY and Tokyo sessions as domestic activity on each counterparty is likely to peak at those times.

Cable moves by the most an hour before the Frankfurt close.

USDCAD moves by the most an hour before the Frankfurt close followed by the NY open.

AUDUSD is most volatile in the hour before the Frankfurt closing hour followed by the NY open.

USDCHF is most volatile an hour before the Frankfurt close followed by the NY open.

EURGBP is most volatile an hour before the Frankfurt close and an hour after the London open which is also the Tokyo close.

NDUSD is most volatile an hour before the Frankfurt close followed by the NY open.

AUDNZD is most volatile at the Sydney open and remains volatile during the Sydney/Tokyo overlap. It is also quite volatile an hour before the Frankfurt close.

USDHKD is most volatile in the two hours after the Tokyo open and then the two hours into the Frankfurt close.

USDSGD is most volatile at the NY open and an hour before the Frankfurt close moving 14.9 pips in both hours followed by the two hours after the first hour of Tokyo.

Donnelly, B. (2019). The Art of Currency Trading: A Professional’s Guide to the Foreign Exchange Market. John Wiley & Sons. (pg. 50)

Also would be curious to know how you would apply some of your datasets to your own trading, how much do you take into consideration? I guess just having an awareness is helpful.

Lots of data to digest here :)

As someone living in Australia and being a early sleeper/early riser I have had to forfeit trading the most vol sessions being NY opens. But there's other options, and according to your stats, AUDNZD would be ideal for the AUD morn session to grab some pip movement.

But like yourself I'm not so much involved with day trading, so finding the best days/months to trade has more use, but interesting to know.

nice work