When Bitcoin Zigs and Altcoins Zag, Who Leads and Who Lags?

Crypto Factor Not Bitcoin Factor May be the Catalyst

It is not clear anymore if we’re in a crypto bull market. Sure, Bitcoin is still above 100k (as of writing), but DeepSeek may have finally popped the AI bubble for all one knows. While a promising recovery seems underway, guess which asset didn’t get the memo—Bitcoin—it’s down by a percent as of writing. It appears that Bitcoin was left holding the potato. It’s a bit weird because, on the surface, crypto’s future has never looked brighter. What with a pro-crypto admin already busy on the plumbing, and rumors of a Strategic Bitcoin Reserve, shouldn’t Bitcoin be on its way to the moon? Furthermore, what does Bitcoin have to do with DeepSeek anyway? If you love a good conspiracy theory, you could argue that DeepSeek has people worried China might crack Bitcoin’s encryption—that’s what they said when Google unveiled its quantum computing chip Willow. No, a much simpler explanation is that Bitcoin’s correlation to tech stocks has withered, and just three days before, it had made a new all-time high.

According to data from CryptoQuant, the correlation between the BTC price and the NASDAQ Index reached a new all-time high on Saturday, January 25. —Bitcoinist.com

Here are the two of them in an hourly chart.

The same people asking what Bitcoin has to do with DeepSeek should first ask what Bitcoin has to do with US tech. Answer? They were (are?) both at the heart of the speculative bubble. The market is all fear and greed. Greed chose tech and Bitcoin; now it’s choosing tech while leaving Bitcoin behind. This begs the question: Is this it… Is this the end of the crypto rally?

It’s a big question because crypto moves in cycles and the higher it goes, the harder it falls. The most bullish crypto traders might look at all this and say “You know what? This is just a bear trap.” Okay fine, but how confident are you that this is THE dip? Who’s to say Bitcoin won’t fall some more? A bear market officially starts after a 20% drawdown. Bitcoin is only 8 and a half percent away from its all-time high. It’s too soon to tell. Still, this kind of FOMO is what is driving the recovery. No one wants to look back later and say they missed the dip in Nvidia. FOMO btw, is another name for greed.

Let’s ask an even bigger question: how do you time the start and end of a crypto cycle? By now I’m sure you’ve been disabused of the notion that the market—especially the current one—cares about fundamentals or anything of that sort. And even if it did, what fundamentals would crypto investors care about? How do they seemingly all together decide that it is time to buy, or sell? I hate to say it but it’s true.

It is said that nothing changes sentiment like price. After a month of turning over stones to find something that could give you an edge in crypto, I’ve come to realize that price is all that matters. Think about it. What have all the Bitcoin evangelists been saying recently? That it’s going to $1 million next. That’s the milestone. Well, what happens when it gets there?? Everything being done to promote crypto has nothing to do with decentralizing finance. Even Ripple, formed by Bitcoin engineers to overcome some of Bitcoin’s hurdles, and supposed to be the bulwark for decentralization, is allegedly busy undermining efforts to establish a US Bitcoin reserve. Trump understands that people buy crypto because they expect its price (not its value) to shoot. So he launched a meme coin—a worthless token—fully expecting it would go up.

Bitcoin price is often taken as the speedometer during a crypto cycle. How then did the first cycle start back when it was just Bitcoin and a few odd coins? It’s a chicken and egg problem.

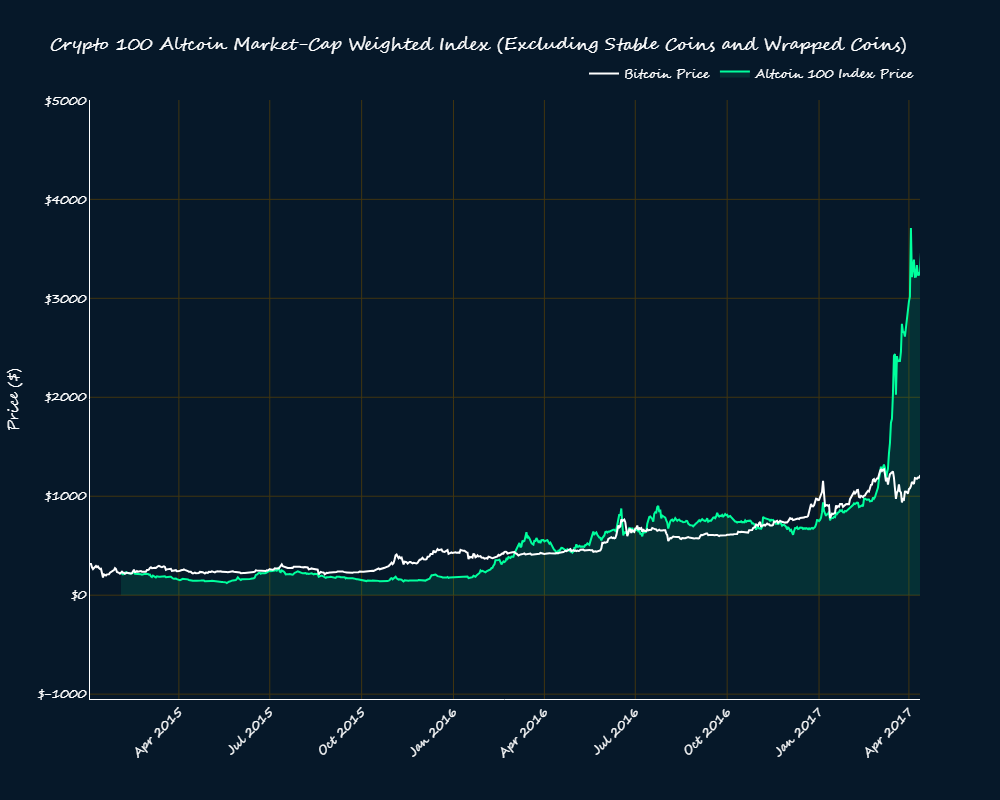

I found out what came first by accident. I set out to backtest crypto breadth as a leading indicator for a cycle to see if it could help time the market to avoid large drawdowns, and perhaps help you avoid round-tripping the top. I decided to use the percentage of coins above their 50-, 100- and 200- DMAs because, unlike advance-decline, these indicators have thresholds you could use to generate signals. However, I faced the rather daunting task of having to backtest a representative enough sample of the 10,000+ active coins, which I assumed would include many of them. So I took a shortcut: I used an index of the top 100 Altcoins (excluding tokens and wrapped coins). The data spans January 2015 to Dec 2024. Here’s the chart. The Altcoin index starts on Feb 1 at the same price as Bitcoin was on that day ($227.27).

Notice that at the start of the first Bitcoin cycle, Altcoins led Bitcoin. This is contrary to popular opinion.

Historically, the beginning of crypto bull markets has often been marked by a surge in Bitcoin's “dominance,” a measure of Bitcoin's market value relative to the total cryptocurrency market. This trend emphasizes Bitcoin's role as a leading indicator for the broader crypto market. Typically, a rally in Bitcoin precedes wider gains across altcoins. — Grayscale

The first cycle is said to have been 2011-2015, but my data starts from 2015. Still, this shows that the idea that Bitcoin leads Altcoins in a cycle may not necessarily be true. Here is a close-up showing 2015 to early 2017. You can see that Altcoins were more bullish. My interpretation is that as more and more altcoins were made, Bitcoin’s role as the premier crypto took hold. It is the Altcoins that increased Bitcoin’s credibility and status as the original crypto. From a psychological perspective, this can be explained by anchoring bias.

Where then did the idea that Bitcoin leads other coins come from? It came from charts like this one:

The problem with this chart is that it doesn’t give definitive proof that Bitcoin leads Alts. Market cap isn’t necessarily the best metric for this kind of thing because a lower ex-BTC market cap doesn’t mean investors aren’t already buying Altcoins. Capital dispersion across many coins can mask early accumulation. Notice that a second rally around September of 2021 was ‘led’ by Altcoins. Here is an updated chart. Going back to that first crypto cycle, you can see that Altcoins started the cycle even though Bitcoin was more dominant.

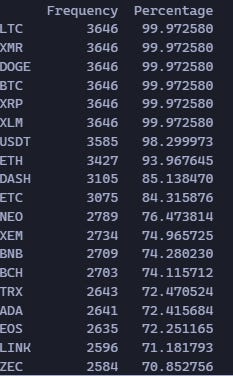

The main counterargument one could make against the price charts I showed earlier is that I only sampled the top 100 coins, and this might be biased (not representative enough). Well not quite, the next chart shows the total number of coins at each rebalancing. At first, there were 82 Altcoins, but after three months there were always 100 coins in the index. You could argue that this is data mining and it introduces a bias but that isn’t so. The point of choosing the top 100 coins is to capture a significant portion of the ex-BTC market cap.

About 15+ coins are in the top 100 Altcoins list over 70% of the time, and 5 have been in that list as frequently as Bitcoin.

Even though coins rotate in out of the index.

The top 10 coins component of the index captures a significantly large portion of the ex-BTC market cap.

And when these top Altcoins lose rank, they don’t fall too far—only 3 of the 10 coins most frequent in the top 10 are no longer in the index after spending the majority of the period under consideration in the index.

In other words, the index is representative enough of the Altcoins—when people buy crypto other than Bitcoin, they often buy one of the top 10 coins so that a crypto cycle can be summarily characterized by just Bitcoin and the top 100 Altcoin index. That said, the crypto market is exponentially bigger in each cycle so this index’s representativeness may vary over time.

So, whether Altcoins do indeed lead Bitcoin or vice versa, as is widely believed, could be a cycle-by-cycle matter. It is more likely that crypto possesses a ‘Crypto’ factor that is either ‘on’ or ‘off’ similar to risk-on-risk-off dynamics in risky assets. Regardless of which leads and which lags, Bitcoin and Altcoins are strongly correlated in a cycle, therefore, crypto breadth indicators can be used to time a cycle’s beginning and ending. It should be possible to use them for Bitcoin entry and exits. I backtested this and compared it to the hypothetical Altcoin index with a starting price of 100 on Feb 1st, 2015. I will present the results in the next post along with the code for premium members.

Thanks for reading! Any feedback or criticism is welcome.