What Does a VIX say???

An estimate of volatility? A fear gauge? A measure of hedging? What ?

There’s some stuff you oughta know about the VIX.

There is a no-arb relationship between VIX and VIX futures.

S&P 500 futures cannot deviate too far from the S&P 500 because that would present a free lunch for someone out there. All they would need to do is go long or short the futures and offset this with a basket of stocks replicating the S&P 500. The same can’t be done with the VIX. It isn’t possible to replicate the VIX in real-time i.e. by buying and selling the underlying’s options because the weighting of calls and puts used in the calculation changes very fast. Because of this, at least in theory, the VIX and VIX futures are essentially different things and can deviate significantly. Practically, market algos don’t let it happen.

This only goes to show the layers of complexity in the volatility world. Not only because the VIX an approximation of 1-month forward vol, but volatility itself is an unobservable quantity. So the only way to tell if the VIX is doing a good job is to compare it to other approximators of future volatility like GARCH models or what have you. Then, when you go to trade it, the available instruments are not really linked to the VIX by the market forces i.e. the possibility of arb. The way I see it, the VIX tries to tell you what hedger’s think about future vol, and VIX futures try to tell you what volatility trader’s think about future vol. The differences in the two can give some useful information as I discussed in the previous post.

VIX options and futures share expiration dates.

This means that the VVIX is actually an estimate of volatility in the VIX futures and not the VIX itself. It’s a subtle but important difference. Put simply, who would be buying VIX options for insurance purposes if not someone with exposure to the VIX futures, which aren’t necessarily linked to the VIX?

I previously highlighted three ways that you can use a volatility index.

To gauge one-month forward volatility, albeit with a grain of salt.

To find a good time to buy vol/hedge portfolio (when inverse correlation with underlying is weak)

To check if a volatility spike is meaningful (if it is, short-term futures follow the VIX)

If you haven’t read it, you can check it out here:

I hadn’t planned to write that post. What happened is I read a two books and a bunch of articles about the VIX which made interesting points, but there was no consensus about what the VIX measures, if it is actually a ‘fear guage’, whether it can be used to hedge, and more. This only fueled my curiosity, and I realized that besides the books, most of the other authors hadn’t done the leg work. I won’t mention anyone because I don’t want any trouble, but the main arguments and my thus-far-informed research are as follows:

That the VIX isn’t a ‘fear gauge’.

I read a compelling article that argued that the idea of the VIX as a fear gauge is just something that got passed around trading desks and propagated without any supporting evidence. The author’s hot-take was that statements such as “The VIX has risen to level not seen since X” were meaningless since the VIX was just a reflection of market activity, which is solely about demand and supply. I also read an academic paper that argued that actually, the VIX measures the utility of a risk averse investor, and what this risk averse investor fears changes depending on what the market is doing. Sometimes this investor fears that he won’t be able to exit his positions, so he buys a backdoor, and sometimes he is short and fears the market will shoot up. Therefore, the VIX is like insurance for both the buy side and the sell side.

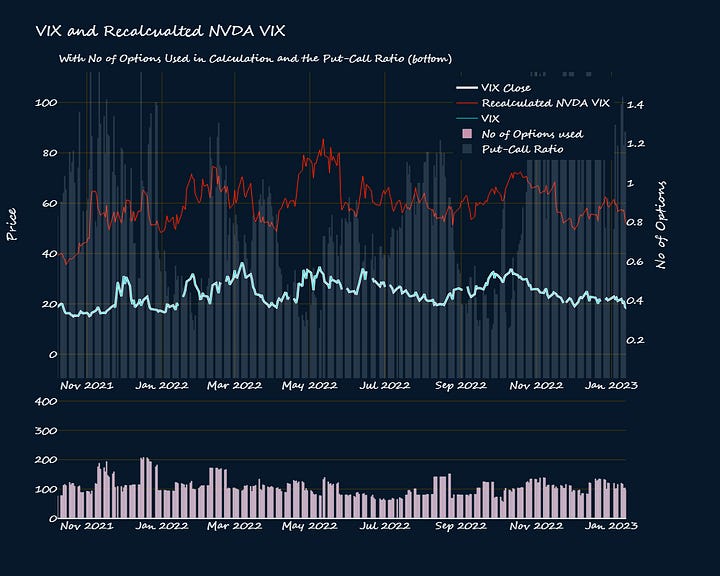

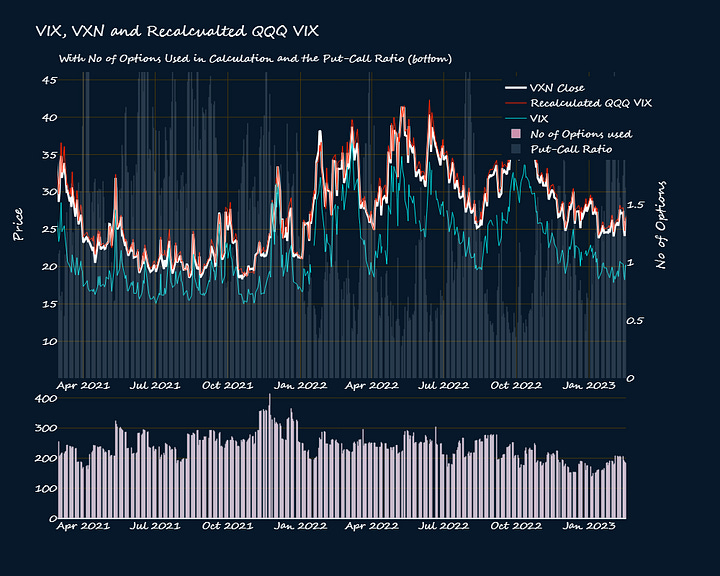

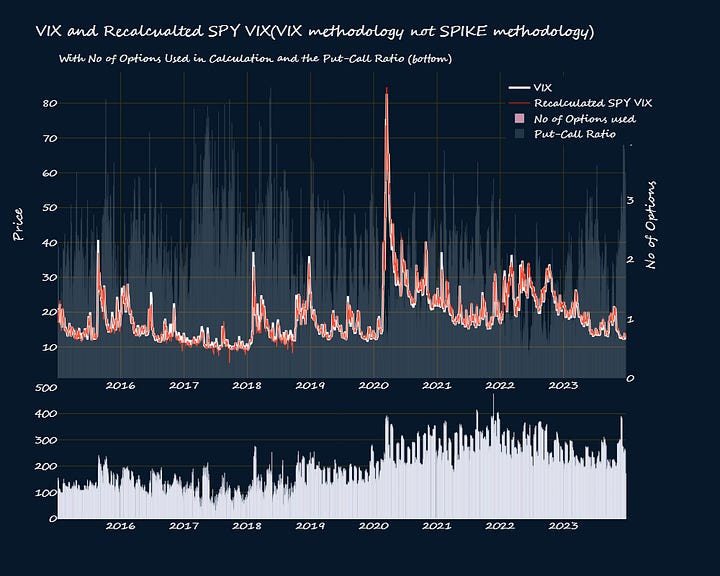

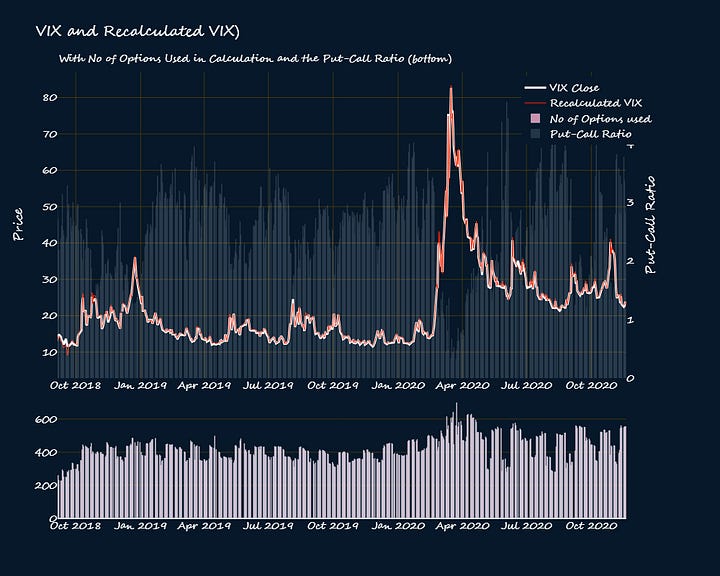

That argument really got me thinking which is why in the last post, I added put-call ratios and the number of options used to calculate the VIX. If indeed the VIX measures this kind of utility, the VIX should have an inverse relationship with the put-call ratio… and it does. Here are some of the chart that show this: VIX (white), Recalculated VIX (red), number of options (bottom) and put-call ratio (grey background).

Notice that the PCR is almost always far above 1, but it goes below 1 when the VIX spikes. That’s because when the VIX spikes, and the market is going down, the only utility a risk-averse investor would need is if he is short and want’s to protect himself from an abrupt market recovery. Other risk averse investors would not buy downside insurance at this time as it would be too expensive. So the VIX is a fear gauge in the truest sense of the word: it captures whatever the most fearful investors are doing.

The VIX doesn’t give any useful information.

The rub, for those who made this argument, is that the VIX is untimely. It can double at any moment with no forewarning. On Feb 5th 2018, the VIX rose from 17.31 to 37.32—more than doubling in a single day. That one day blew everyone who was short vol out of the water, and changed the vol landscape for good. The XIV (inverse VIX) ETP was wiped out, and the UVXY and SVXY both reduced their leverage size by 0.5x. It’s not that no one thought something like that could happen. There were various people who warned against the then extremely popular short-vol trade. The problem was that for about 20 years, it had really paid to be short-vol, and there were so many ways you could do it. The funny thing is that the move coincided with a -4% move in the SPX and the talk at the time was that actually, the drawdown in the equities market was because of short-vol traders having to cover and algorithms seeing this playing the S&P 500 - VIX correlation in the VIX futures markets.

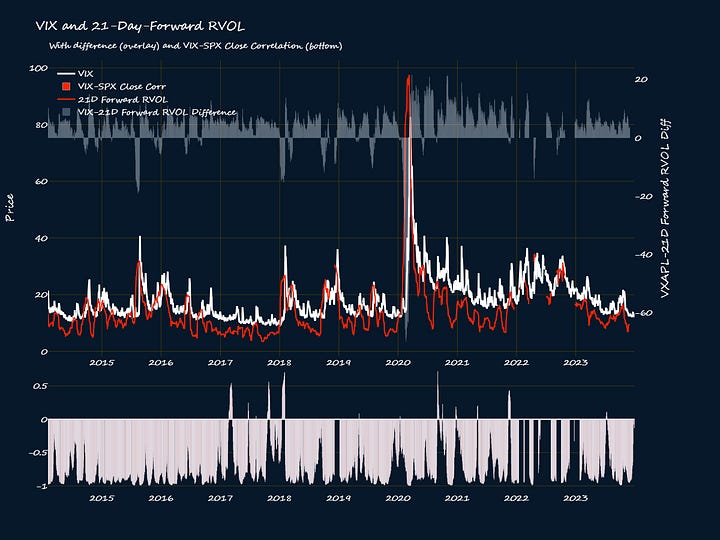

This shows that when it comes to the infamous VIX-SPX inverse correlations, it’s hard to know if it’s the dog wagging the tail or the tail wagging the dog. All in all, the VIX isn’t a reliable leading indicator due to it’s untimeliness. I showed in the last post, the VIX isn’t actually bad at estimating future RVOL, but it doesn’t necessarily have a one-to-one correspondence with future 30-day vol. Furthermore, it overestimated expected vol in normal times, underestimate it in turbulent periods. The best it can do is give you a general idea of the volatility regime in the near future.

One argument that has stood the test is that the VIX measures hedging and can be quite useless when no one is hedging. There is some truth to this. In the late 90’s, the then VIX, called VXO, moved up with equities as the dotcom bubble went on. The VIX is supposed to go down when equities go up for it to posses hedging benefits, so it really boggled people’s minds when that happened. The best explanation in my opinion is that some people were buying back doors even as the dotcom bubble progressed. If that’s the case then I’m not sure you can say that there are times when the VIX doesn’t measure hedging. I was curious about this so I dug a bit more.

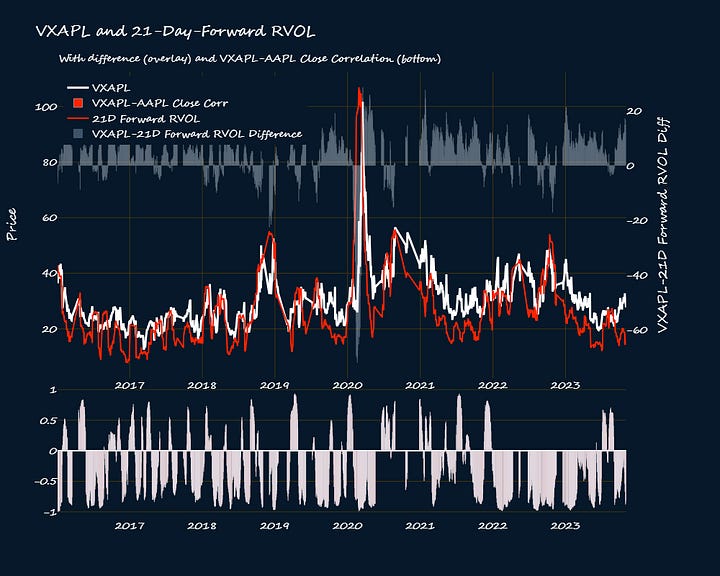

The bottom panel of the above two plots shows 21-day rolling correlations between the underlying and the volatility index. So VIX vs SPX correlation and AAPL vs VXAPL correlation. Notice how for VIX-SPX the correlations were almost always negative even though there are a few times when it was actually positive. Then for VXAPL - AAPL, there are more times when the correlation is positive. I think it’s safe to say that this is because you expect more hedging in the index than the equity.

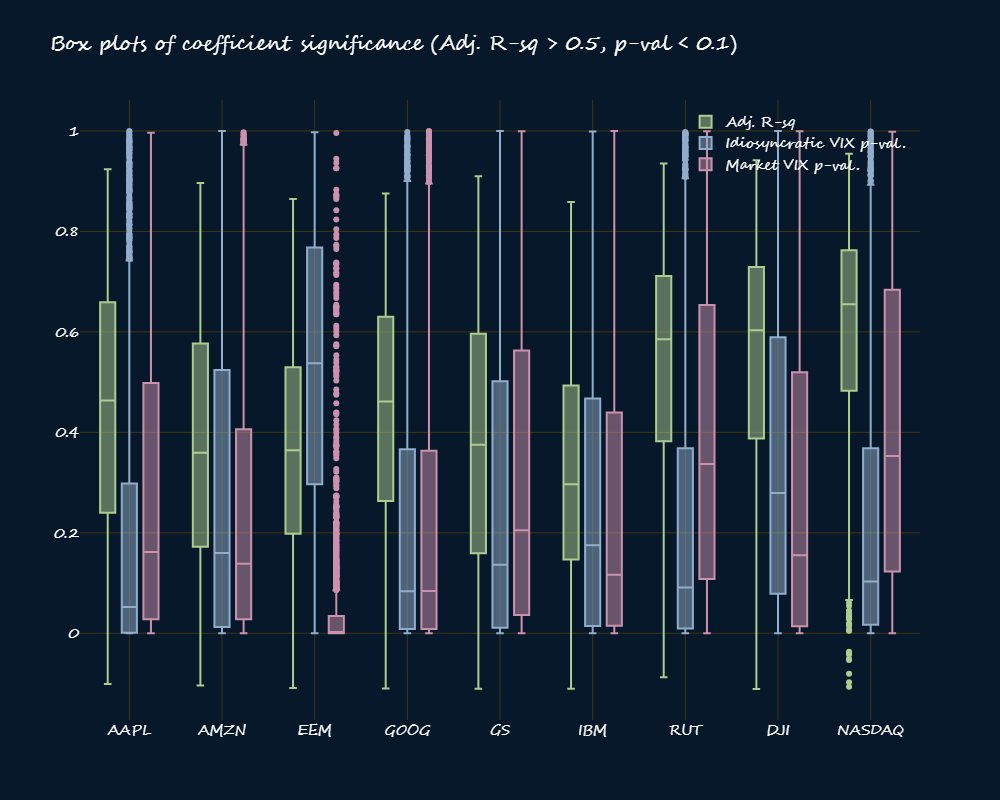

Another thing to look at would be the regressions of the volatility index vs the underlying. I gathered the following assets and their vol indices, then created 21-day rolling windows of the pair of return series. I then fitted a regression of the asset’s return against its volatility index’s returns (Its idiosyncratic VIX).

The box-plots show the significance the adj. R-squared (green), idiosyncratic VIX p-vals and market VIX p-vals.

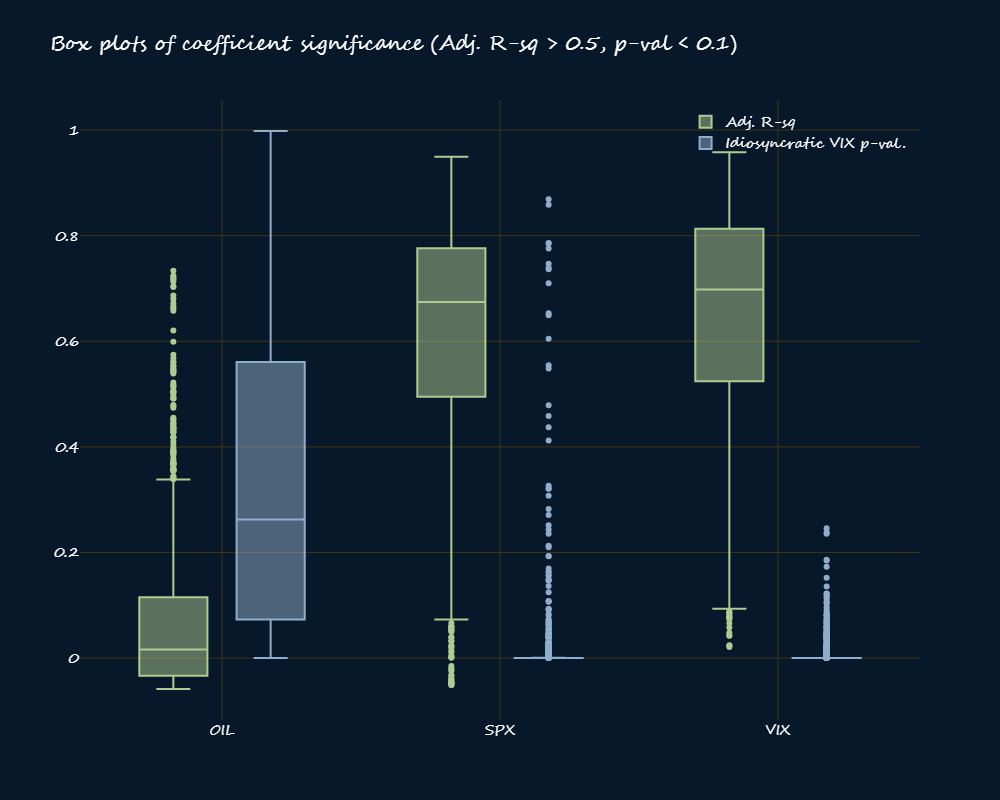

Notice that Russell 2000, Dow Jones and Nasdaq have higher Adj. R-squareds than the equities and the emerging markets (EEM) ETF. Nasdaq and Russell 2000 have low p-vals too, but not the Dow. Same case below, SPX and VIX have high Adj. R-squared and low p-vals, but not oil.

So indices are more sensitive to their VIX, but their sensitivities differ with the SPX being the most sympathetic to it’s VIX and Dow the least.

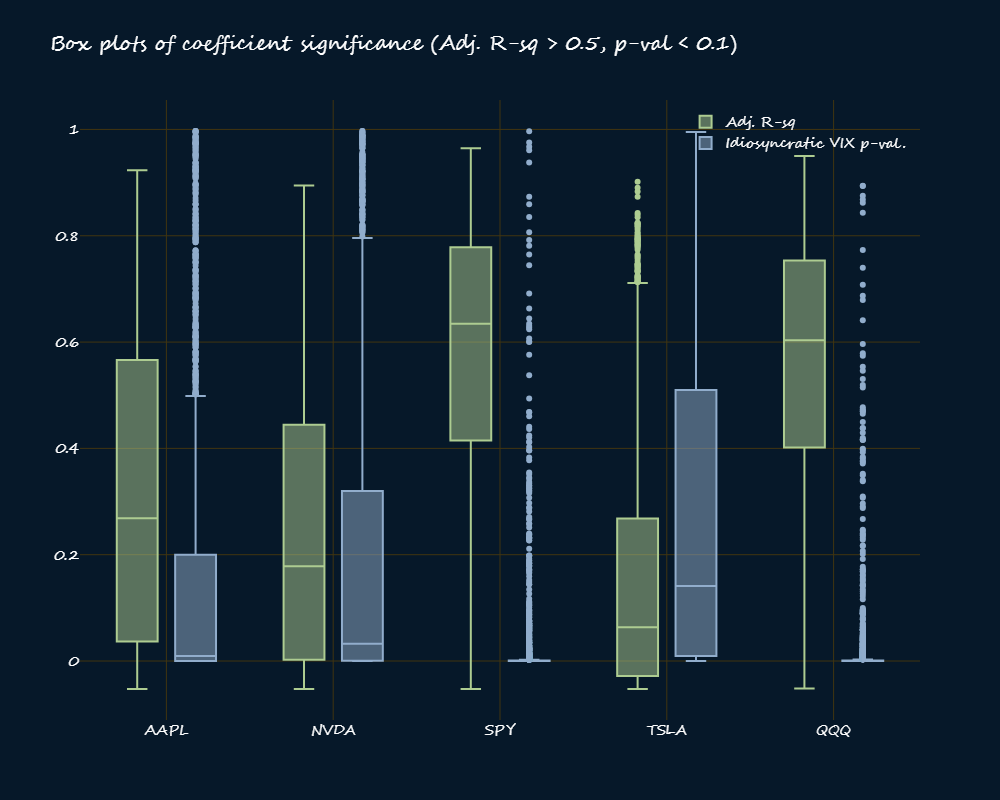

Index ETFs also have quite a high proportion of significant Adj. R-squared and a high proportion of very low p-vals.

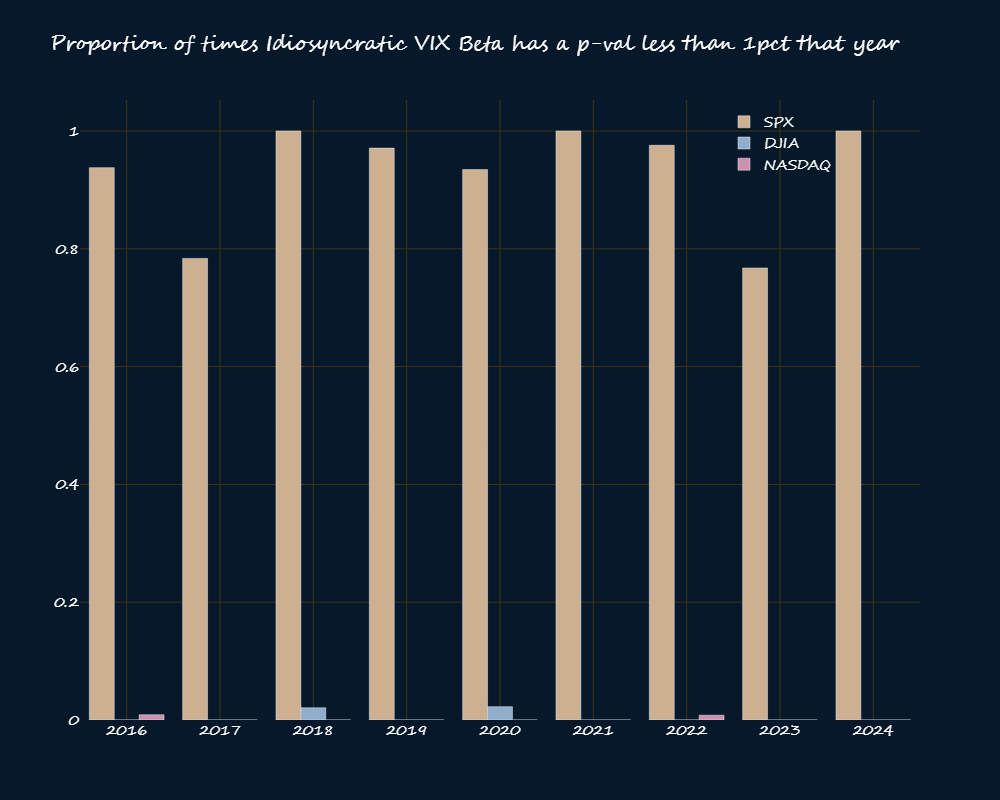

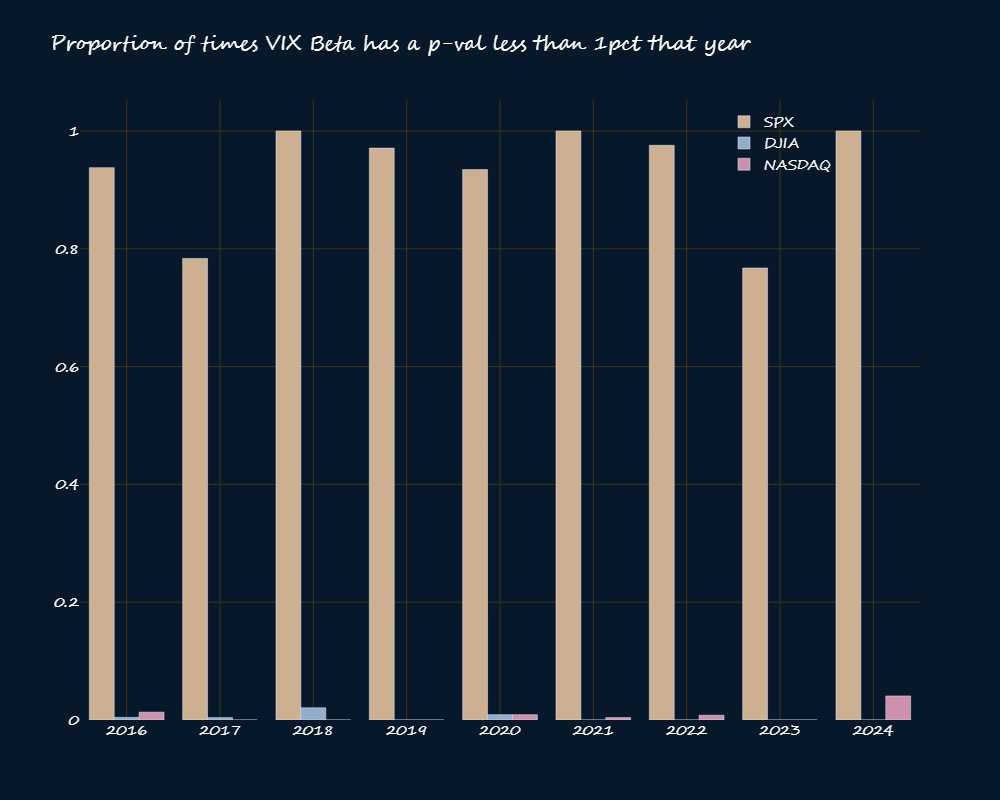

I also checked the proportion of times the regression betas had a p-val less than 1%. For the SPX, the number was almost always north of 90%. You can say that nearly all the time, the VIX is being used to hedge. But the same can’t be said of the Dow or the Nasdaq. Mind you, these are their idiosyncratic vol indices (VXD and VXN, respectively)

Here is the same thing using only the VIX as the vol-index for all three.

You can see that only the SPX is highly sensitive to its VIX, the rest are nowhere near. I thought about this a lot and my thinking is that it’s because VIX futures and options are very actively traded. It makes sense that vol traders hedge using the SPX and since volatility traded, then the demand for SPX exposure to hedge the VIX is always there.

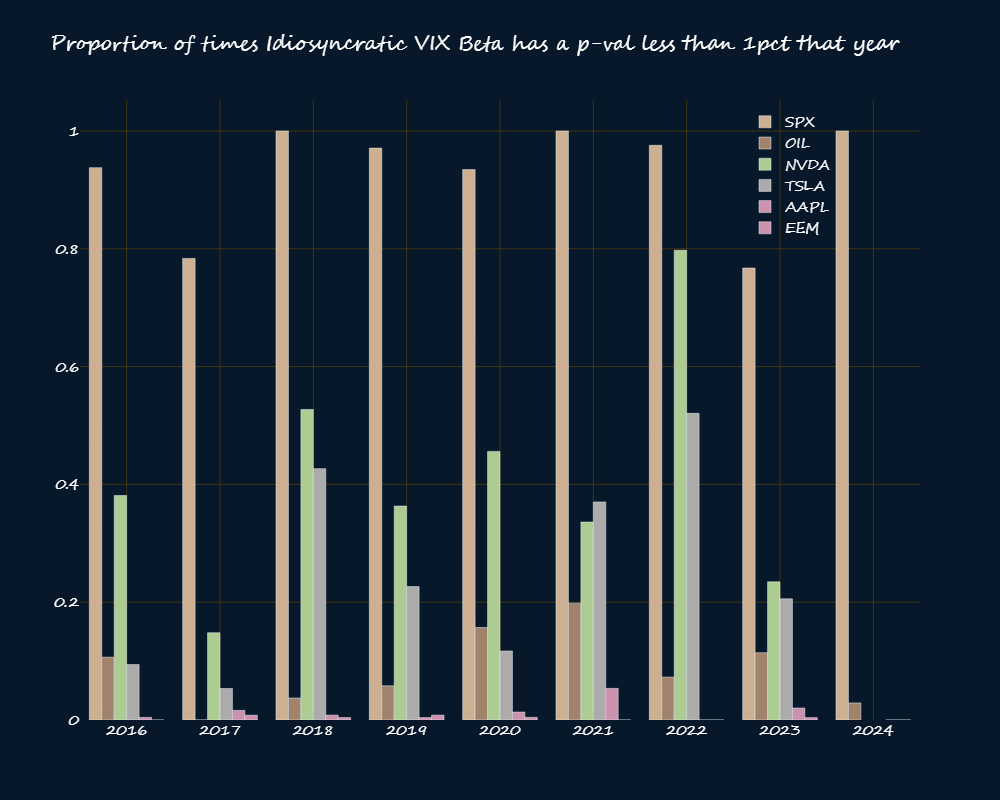

What about other asset classes besides indices? There was some hedging activity in Tesla and Nvidia. Not so much in AAPL, and virtually none in oil and EEM.

At first you could say that all three stocks are part of the SPX so that’s where that is coming from. But these are idiosyncratic VIXs i.e. they were calculated from each stock’s options so they do measure idiosyncratic hedging not market-wide hedging. That’s why AAPL’s proportions of significant betas is so low: no one is hedging the number one company in the world. So I guess to say a vol index is useless if no one is hedging is somewhat right.

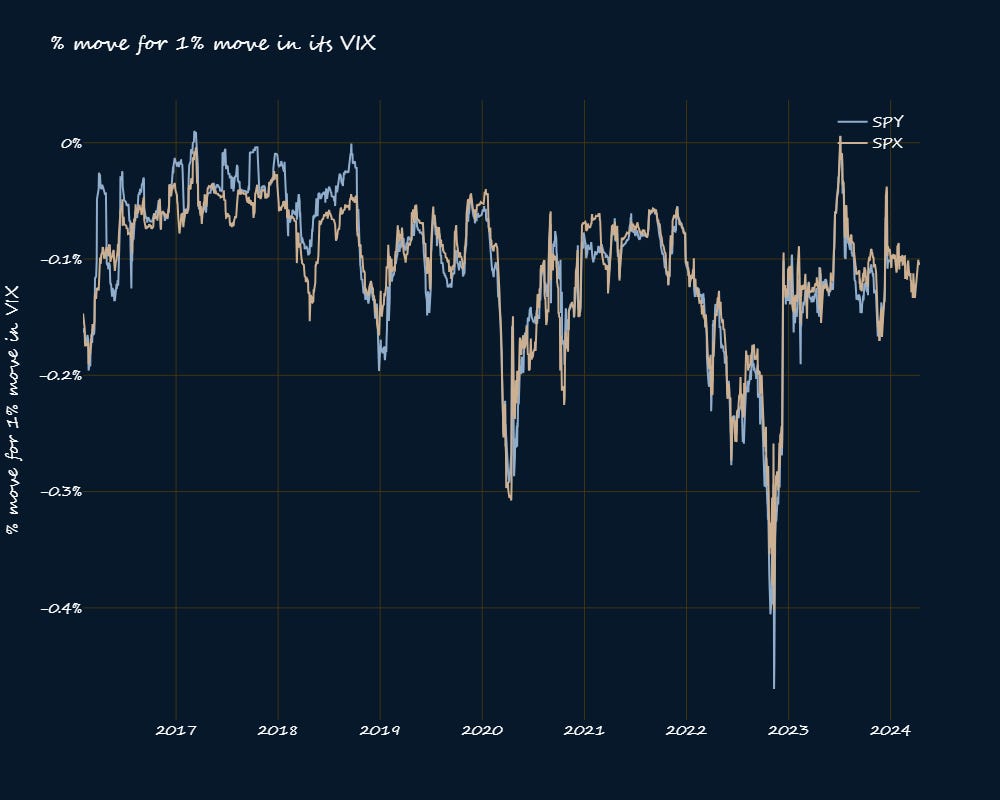

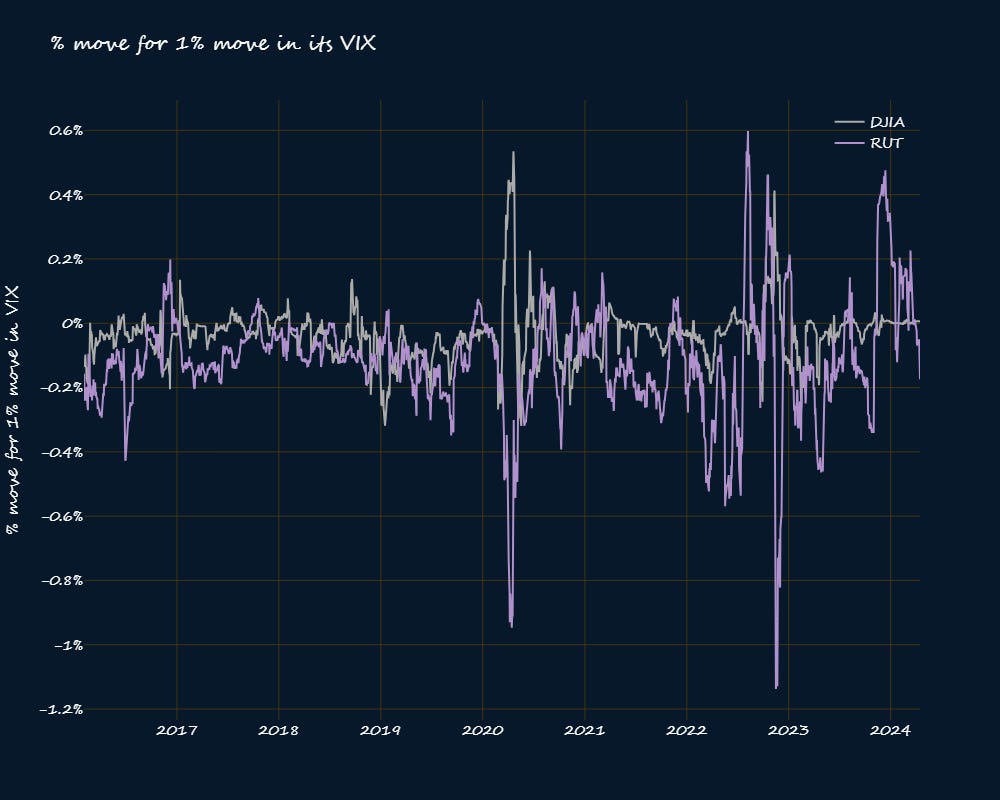

Apropos hedging, here is how much bang for your buck you get for each asset. The charts show how much an asset moves for a 1% move in its VIX.

For the SPX, it’s almost always negative with the most bang occurring towards the end of 2023. I can’t recall anything significant happening other than the market started going up, up and away—which is exactly when you would expect people to start hedging I guess. To be honest I’m scratching my head at that one. The other time was during covid’s start which makes sense.

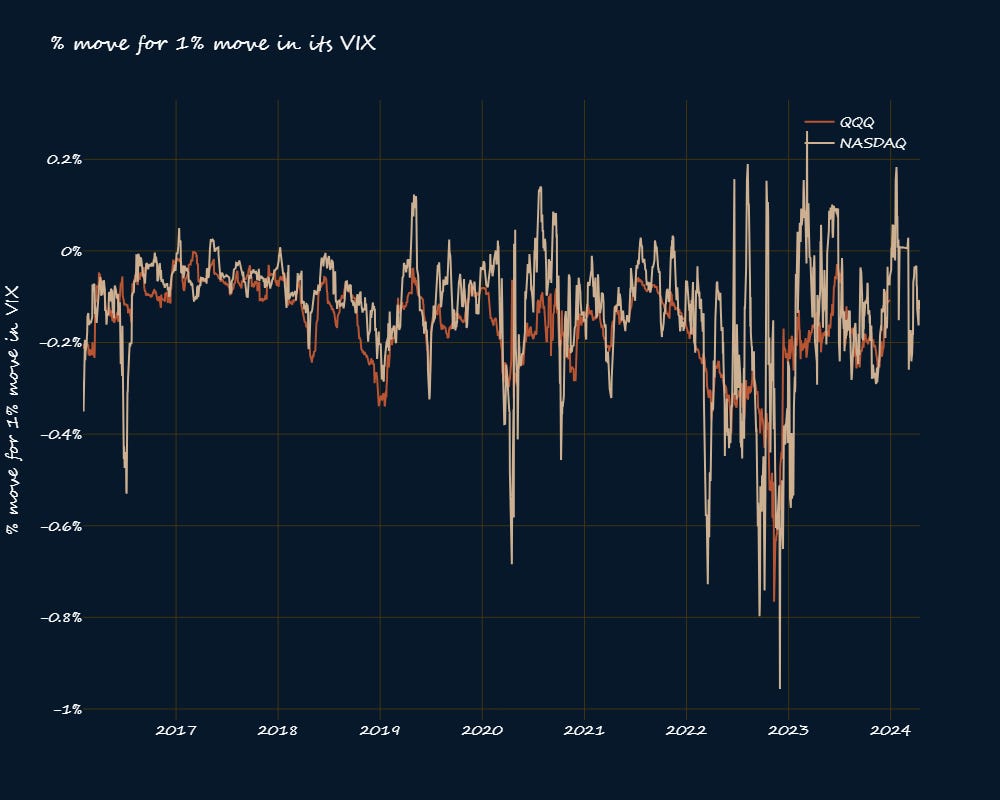

While the p-vals of regression of the other indices’ returns to their vol-index’s returns were low, the charts below show that there are hedge effects nonetheless. This is one of those situations where you have to think about correlation and causation. Afterall, in times of trouble market correlation goes to 1.

The Russell 2000 benefits the most when it’s hedging time, while the Dow seems to be positively correlated to the VIX in times of turmoil, like during the pandemic start. I will have to look into that all this some more.

Since we’ve seen that the S&P 500 was the only asset whose p-vals were consistently less than 1, and the expected move for a 1% move in the VIX is always negative, you can argue that the VIX is always a good measure of hedging in the S&P 500. For the other indices, their volatility indices offer hedging benefits, but not always. The Dow even seems to be positively correlated to its volatility index, VXD, during times of turmoil like the covid start. I will discuss more about hedging using volatility in another post after I’ve done more research.

Lastly, since the VIX tends to spike during a market downturn, I was wondering if there is a way to play the reversal i.e. use it to know when to buy the dip. I’m still working on that and other backtests.

As part of the research for the VIX studies, I read ‘The VIX trader’s handbook” by Russell Rhoads.

It’s a good book about vol and the insights are super helpful to anyone interested in trading vol. Right now vol traders are excited because of the French elections thing, the upcoming US election and the fact that the markets look toppy. There are some possibilities for doing some spreadbets of these different narratives. If you want a vol guy, Russell has a great substack!

Another substack in my ‘must read’ list is Stephen Kircher’s ‘Institutional Economics’.

Stephen is an independent thinker and a great writer. I always find what he has to say useful to my understanding of the markets.

That’s all for now, until next time.

Share this with someone who might find it helpful.