Editor’s note: This post and it’s email form were initially posted via beehiiv which I’m testing for a potential move.

Every Monday, I get an email from CMC with the new Crypto listings and top trending coins. Here’s the one from this past Monday.

I usually give it a quick look and then delete it, but not so long ago, I started wondering: should I give a #@%! about this? It bugged me so I decided to look into it.

I have data for over 8000 active coins painstakingly gathered from CMC (which I will be sharing with paid members soon). I wanted to find out how they perform on t+1. The data has a ‘launched date’ column. My plan was to simply calculate the percentage return on t+1 and look at it’s distribution. As far as data analysis goes, this was as easy as they come.

The first question I had was: roughly how many tokens are launched each week? That’s what you are looking at in the chart below. For a long time there were fewer than 20, than 10 even, but in 2024 it was about 20 to 40 each week. “That’s a juicy opportunity set if this turns out to be a thing!”, went my lizard brain. But it dawned on me that ‘launched’ doesn’t necessarily mean listed. So I went back to the data and found that thankfully CMC provide a ‘first_historical_date’ column as well. “Phew! That must be when it’s listed”, I thought. So I plotted it on top of the launches. “Wait, why are there more listings than launches?”.

That’s a valid question. It’s because some listings are derived from already launched coins. That and the dreaded zombie projects—those that never make it to launch. Yikes.

“What if I focused only on the actual coins, and ignored the tokens. Coins have more intrinsic value and I lower chances I’ll get rug-pulled, right?”, I thought. I mean, one could do that, but the opportunity set is much lower. Here is the same chart for coins only. You’re lucky if you get 3 new coins in a week.

And again for tokens only. Definitely a lot more.

Then came the first hurdle. Some coins (I’m using the terms loosely to mean cryptocurrencies, whether coin or token) traded well before their launch date. Hmm.

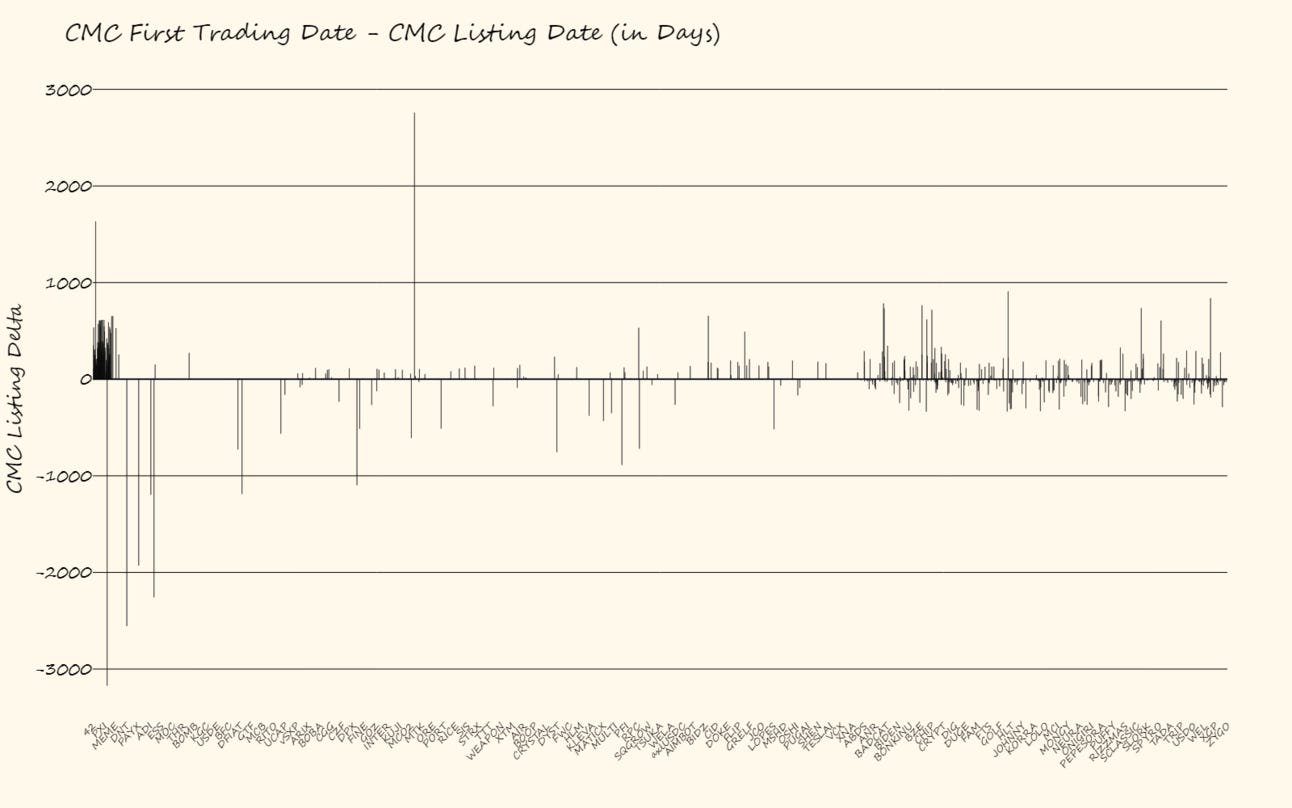

What you’re looking at here is the delta between the first trading day and the launch day. You would expect the delta to be always positive—a coin should trade after it is launched no? Okay, how about listing delta. Surely that is always positive. How can a coin trade before it is listed!?

It’s not as bad as the launch date delta, but some coins do trade pre-listing. Well, before they are listed on more than one exchange (a prerequisite to CMC including a new coin to it’s database). However, It turns out that some exchanges allow trading is some coins (like hyperliquid recently) before they are listed. According to this reddit post, these exchanges are simply facilitating a synthetic price. TradeFi guys, I feel the lead in your stomach.

Okay, you know what, there’s no way I’d buy a coin that wasn’t listed on more than one exchange. I decided to just use the CMC listing date for my study. Next hurdle: some coins trade way after they are listed—sometimes years after. Better to simply use the first trading day for each coin.

Alright, so how do coins fair after they are launched, I mean listed, I mean introduced to the market (listed or otherwise). By now, everyone knows not to trust a new listing, I’m sure. You get a new rug-pull story every week. Some are bad because then you have to go into hiding to avoid difficult questions.

Even Binance put a big ‘beware of rug-pulls’ sign on their front lawn. But it’s not all so bad. Of the 8301 coins I analysed, 42.81% had a positive next-day return, 40.39% had a positive three-day return, 22.18% were still rocking on six months later and 21.18% are alive and well today. So not all bad, if you ignore the worrying trend of declining coins with positive returns the further out you go.

What you and I need is a sure-fire way of finding these few special ever-green coins, assuming they don’t have nasty drawdowns. But that right there is the rub. There’s not much to go on in crypto. Why would you expect one coin to outperform the next? Why didn’t $MELANIA outperform $TRUMP?; everyone knew about $MELANIA, no one knew about $TRUMP. Crypto is a problem for many analysts for this reason. I recently set out to do some style factors in crypto, and after size and momentum, I was grappling for straws. I read a bunch of papers and they all seemed as desperate as I was. One paper proxied the value factor using 252-week lows because ‘it showed a high correlation with intrinsic value factors like number of active wallets…’. Some had inspiring ideas, like using number of google searches to create a sentiment factor. Not an easy feat but an admirable attempt. Another one had a volatility factor, but other than the technical feat, I don’t see why anyone would want that factor unless they had titanium balls. Still, someone out there is running a smart-beta crypto fund and probably making good returns. Part of my reluctance to pursue that line of research is that I suspect most of my readers would not be interested in replicating a crypto style factor in their portfolio—and I don’t like to bore my readers (knowingly at least). But I know some of you guys would like to know how the sausage is made so I’ll still finish it and share the code with you along with the findings.

One question you might ask is whether the post-launch returns for actual coins are different from those of tokens. Should you go back to the meagre opportunity set?

The answer is you don’t get an extra helping a day after launch, but few months later you’d be better off with a coin. To sink this point home, here is the same thing using tokens only. There’s that worrying down-trend again only this time there’s a glimmer of hope as slightly more tokens finish in the black than those that are down six months in.

Anyway, about that distribution I wanted. Here it is in table form.

The average next-day gain is 22% but only 13.2% of coins and tokens beat that. The median is slightly less than 1% and it gets increasingly less the further out you go; just as the number of coins and tokens above their average returns for a comparative period get increasingly fewer. There are some juicy outliers like MICHI that gained a whopping 49,000+% after a week, and 58,000+% after 6 months. Some of the figures are embarrassing to talk about. The average gain from inception is 1.1million% due to coins like PONZIO that are up 7.69billion% which is plausible if you look at its chart.

Some took dirt naps, loosing 99% of their worth. In case you are wondering how many coins take dirtnaps, I made you a chart.

About 19% of crypto end up ka-put. For actual coins it is roughly 15% and for tokens it is 16%. This last chart is better than I expected. It shows that rug-pulls are the exception not the rule; many coins finish 6 months in the black after they start trading.

So should you care about new listings? I’d say no. Only 21% of coins are currently above their starting price, yet we are, allegedly, in the mother of all crypto rallies. Crypto is the wild west—with few barriers to entry and no sheriffs, anyone can launch a coin for whatever nutcase reason they like. The recent Trump meme coin debacle showed this to a cartoonish degree. I am not much of a moralist but part of the reason capital markets exist is to keep money away from idiots and lazy people (companies). The crypto market is doing a bad job at this and is in desperate need of regulation. The funny thing about putting crypto enthusiasts in charge of crypto is that it’s like hiring a hacker to design cybersecurity—they know all the vulnerabilities. Or like asking a fox to design the henhouse’s defenses—they’ll be sure to keep out all other foxes. It’s like asking the worst sinner to write a rule book—they will include every conceivable sin. I fully expect the kind of crypto regulation to be put in place to be bitter medicine for the crypto community. If you disagree, argue with me in the comments.

PS: I will update this post later with some more tables and charts for a more detailed analysis. I have them already, but they don’t add much to the story other than to satisfy one’s curiosity.