A crazy thing about writing is that you often start with a grand idea in your head and then once you’ve executed, you realize just how bland it is. It reminds me of when Sherlock Holmes explains to his interlocutors how he arrived at a deduction and everyone is suddenly unimpressed by them. I had this grand idea that since I had good minute-level data for a bunch of currencies, it would be great to do some exploratory data analysis and profile some of the major currencies. I thought it would be helpful to have some numbers to keep in the back of the head about what to expect. I mean, we all know which session is the most volatile but do we really know how much currency X moves in that session? How about on a given Monday? What about in the different months of the year?

I set out to do the 7 major currencies together, and I also wanted to show how each currency reacts to different macroeconomic releases, but quickly realized that would be way too much for just one post. I need to break them up into several parts because of the workload and also my own sanity (and your reading pleasure). So the plan is to do each currency profile individually and do each macroeconomic release individually depending on what currencies it affects.

Let’s start with a EURUSD profile.

PS: I would appreciate some feedback on whether you find it helpful/useless, and what else I could add. Since I have minute data, the are quite a lot of possibilities. Say you wanted to know the distribution of moves every Monday at 1-2pm EST since 2011, I could do that. I’ll get around to doing some of the important ones like behaviors around important times of the day etc, but if you can think of something you’d like to know shoot me a message or comment (links below). Anyway, without further ado…

Expected Moves in Each Session

The timestamps in the data are in EST, so the sessions go as follows:

Sydney: 5pm - 2am

Tokyo: 7pm - 4am

London: 3am - 12pm

New York: 8am - 5pm

Frankfurt/Paris: 2am-11am

Here’s the average EURUSD range (high-low) in each session (overlaps separated) for the past 14 years.

In each and every year, the three-hour period when the US/EU/London sessions overlap (8am-11am EST/ 12-3pm GMT) has been the most volatile, followed by the two-hour period when the EU/London/Tokyo sessions overlap (2am-4am EST/7am-9am GMT). I’m sure this is common knowledge if you trade FX but the chart also shows that you can expect about 16 pips in the US/London overlap and 12 pips in the London/Tokyo overlap so that can help adjust expectations. When I started trading in 2018, the main guy I learnt from used to say that you should aim for 20 pips a day and be happy if you got more. You look at this chart and 20 pips was the average move in the US/London overlap in 2018. Now it’s 16 pips!

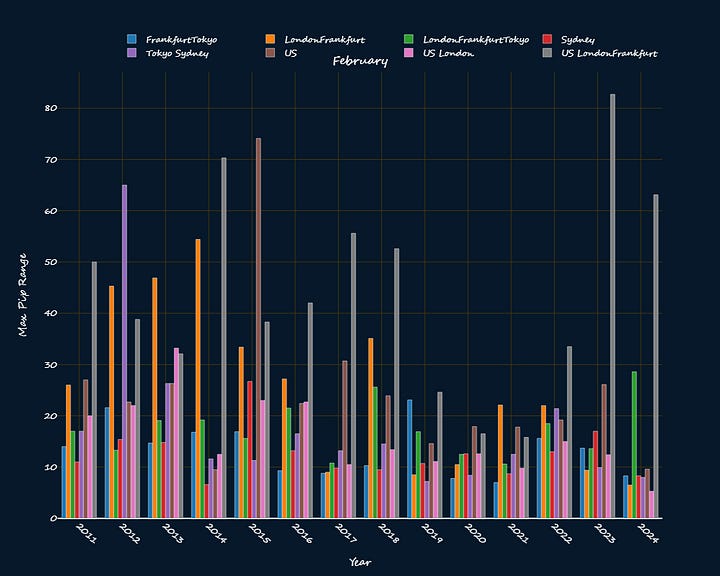

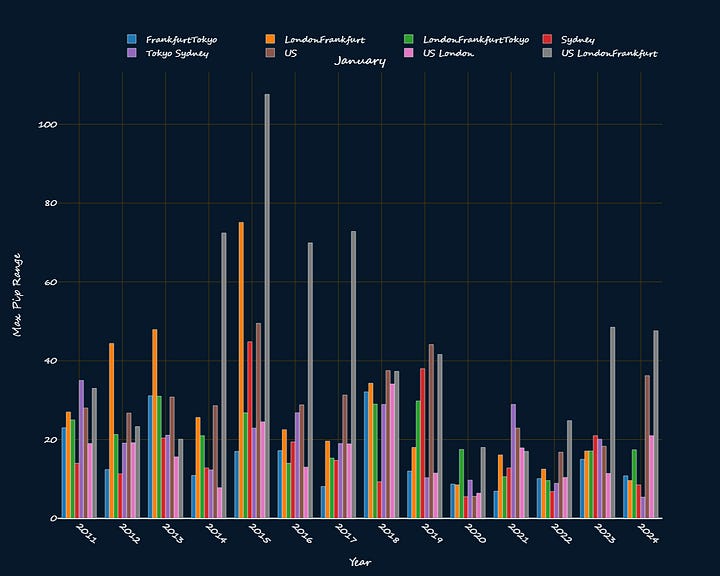

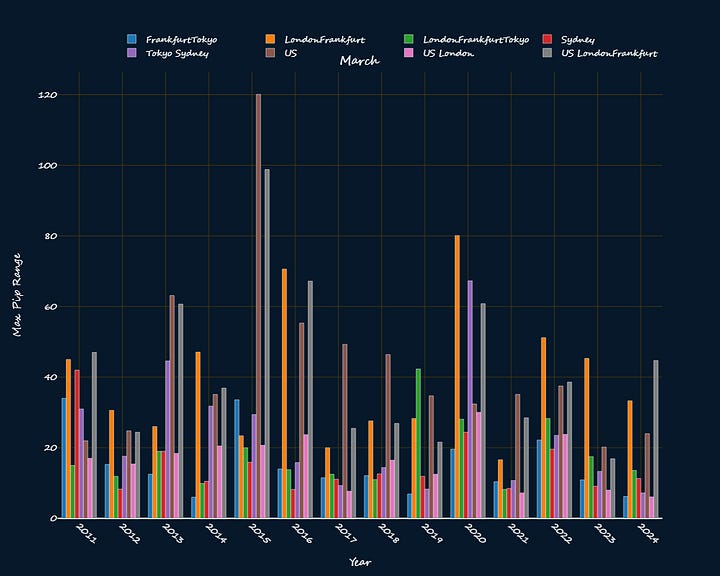

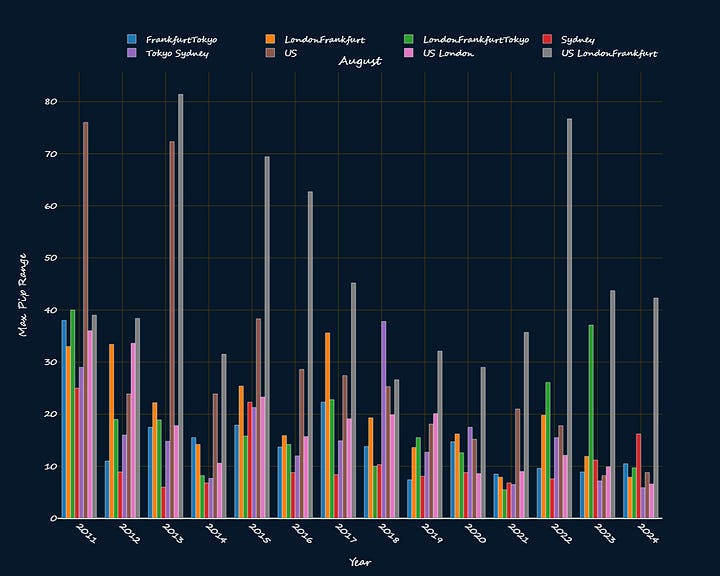

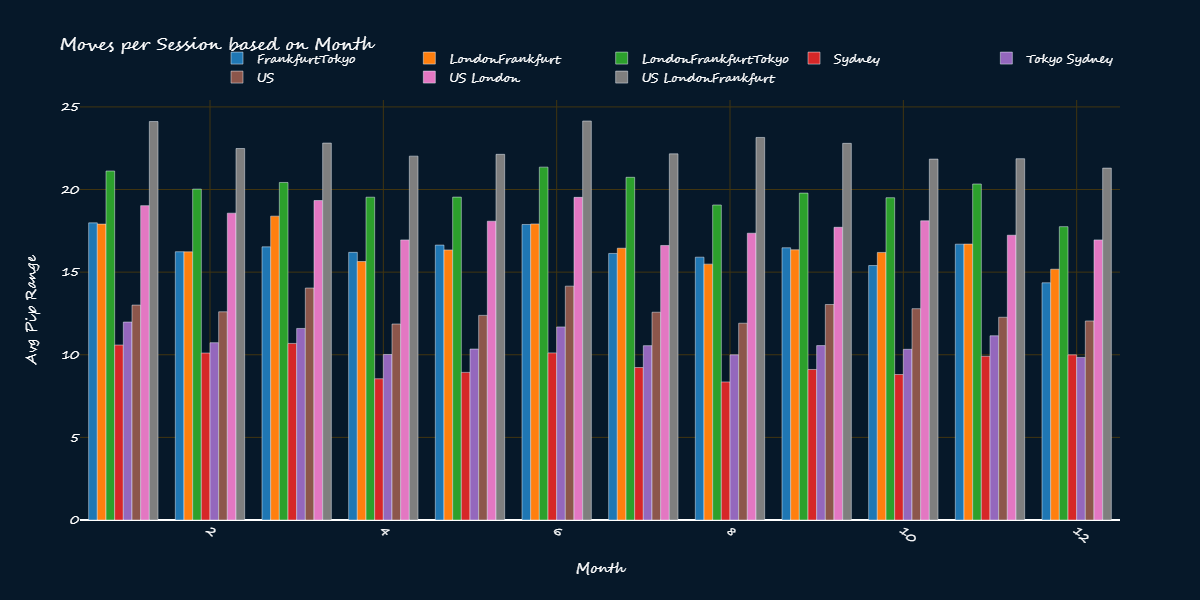

I suppose you’d want to have a more granular look to see the different months of the year as well. Here ya go..

I wouldn’t say there are any meaningful differences in the average moves in each session in different months of the year (no I won’t do the t-tests to prove it :D)

Expected Move by Hour-of-the-Day

I suppose this is just the same information as before presented in a different way. You can see the three-hour period between the New-York open and London close as the most volatile, followed by the London open and Tokyo close period.

Expected Move by Weekday

Because of the different sessions there is a Saturday and Sunday in the data, but we are using the EST timezone (market opens at 5pm EST on Sunday).

Thursday is usually the best day to trade except in 2012 and 2016 when Friday was the best day to trade. Usually Mondays are slow and then volatility picks up as the week progresses and dials back on Friday. In my trading, I use Mondays and Tuesdays to do research and look at price action developments to see if I can get good risk-rewards for any ideas I have.

Expected Move by Month-of-the-Year

I suppose this chart shows how volatile EURUSD is compared to all other months since 2011. Things have been slow this year but August has seen more volatility, but this year has generally had less volatility than the last two years. Hopefully the rest of the year will be better.

Conclusions

Draw your own conclusions, I just make the charts lol

I’m sure many other currencies will show similar patterns as this but the important thing are the ballpark figures. If you are day trading EURUSD, just aim for 20 pips a day. Expect 40 pips on a Monday and 60 on any other day. That kind of thing.

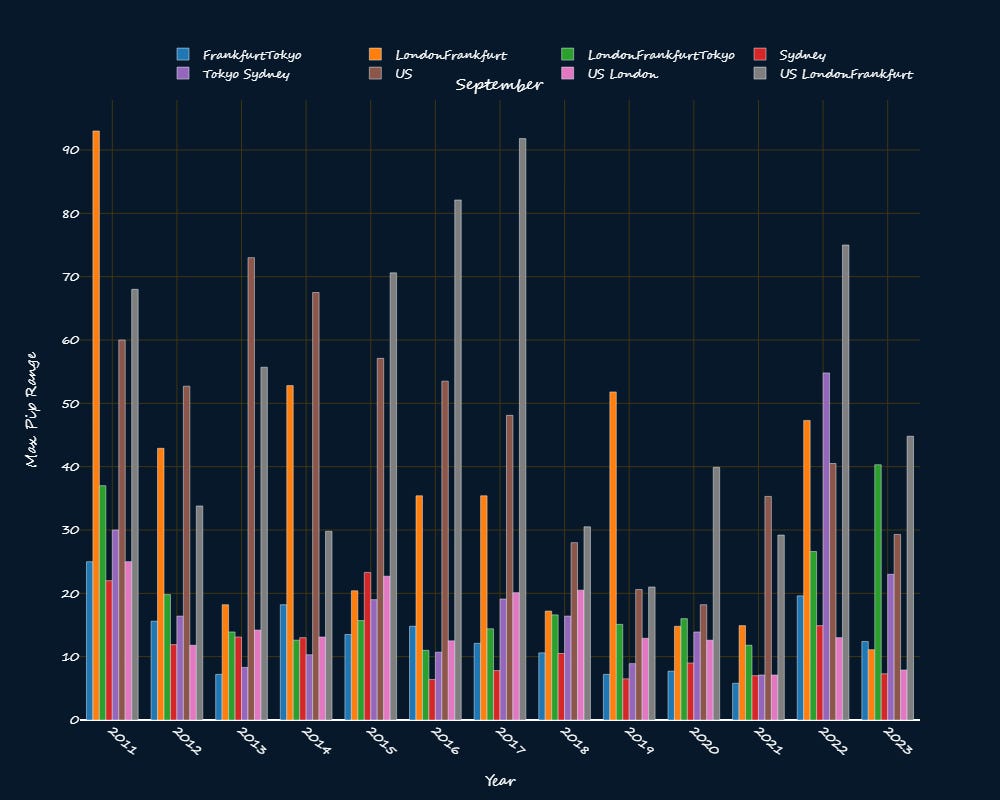

I really struggled with the scope of this idea, and it was very glamorous in my head. So much so that I made charts that showed the average move in the EURUSD in each session for the different months. Here is September’s…

and here are a bunch of other months’.

Afterwards, I didn’t see how these would be useful so I omitted them, but if you can think of something you’d want to see you can either message me or leave a comment below.

cheers, nothing to add here, but will be good to see how other pairs compare. do you mainly trade FX Lago?