Author’s note: I’ve got one more crypto analysis to post—the one about factors—but I’ve put it on the back burner in favor of something way more exciting and useful for tradeFi guys. It involves Trump’s tweets and how to profit from them and its really big in terms of technical requirements. It would sure help if some of you guys subscribed to help with the costs. It will probably be paywalled too.

There’s an ongoing 20% lifetime discount up till Feb 5.

Let us agree on one thing: cryptocurrency is gambling. And before the crypto guys come after me with 'all trading is gambling,' I agree that you can gamble on any market, but that is your choice. In trade finance, you have something to work with; in cryptocurrency, it is all about sheer belief and being in the right coin at the right moment. You can argue with me on this.

In his first week as president, Trump established a subcommittee to address cryptocurrency regulation. He issued an executive order establishing a crypto working group and selected Senator Cynthia Lummis as chair of the Senate Banking Subcommittee on Digital Assets.

Some of the key goals for this group are to help craft a regulatory framework for cryptocurrencies and evaluate the creation of a digital asset stockpile. Some of the key members of this group include the SEC, CFTC, and the Treasury. Additionally, large crypto-related companies are also fighting for seats within the group to assist in helping the crypto space flourish. —Bankless

The SEC chair also formed a crypto task taskforce to develop cryptocurrency legislation.

The announcement noted that the SEC “relied primarily on enforcement actions to regulate crypto” but is now taking a different approach, creating a more collaborative environment. The task force will be led by Hester Peirce, SEC Commissioner appointed by Donald Trump, who will assist in forming the regulatory framework for the crypto space. —Bankless

This is what I believe will happen once new regulations are implemented.

1. The End of Shitcoins As Blockchain Finally Matures to a Force for Good

There are currently more than 36 million coins and tokens on all chains combined. The new regulations will drastically reduce this number. This means that all the capital gets dispersed into shitcoins will rotate into functional crypto—specifically, large-cap Altcoins—and Bitcoin.

ETH is among the coins that will profit the most; it has been underperforming during the current surge against expectation. The chart below shows that Bitcoin and Dogecoin have been outperforming Ethereum. Bitcoin is the prima-donna, so no surprise there, but why would Dogecoin outperform Ethereum?—one has a useful blockchain, while the other is a meme coin.

Etherium has underperformed because people are waiting to see what kinds of uses it will have (what they can do with it) once regulations offer clarity, but dogecoin has rallied due to sentiment and a consensus that it is a'safe' meme coin. The restrictions will disclose what each coin is truly worth based on its utility, and if other nations follow the US or enforce stricter regulations, the future of shitcoins is uncertain. Altcoins like as Solana, which are mostly used to create shitcoins, may lose value.

2. Lower Volatility as Crypto is Put in its Place

Despite surpassing all other asset classes recently, Bitcoin still feels like a 'gamble' and still has shady connotations. If blockchain evolves and Altcoins find valuable uses, the potential impact for AI applications and a mature blockchain, such as intelligent and decentralized processing, could lead to technological innovations. Perhaps this is why Bitcoin is correlated with US tech stocks—aside from the fact that both are currently speculative vehicles. The concern, however, is that this maturity is still years away. Ripple, for example, claims to have applications in banking and healthcare, but a closer look reveals nothing groundbreaking. The gap between what these coins claim to offer and what is currently being implemented is significant.

One could argue that the drag in development is due to developers' reluctance to adopt the wrong platform. The way they see it, even if you choose a ‘safe’ option like Ethereum, there are still more questions to answer like: which part of the Ethereum ecosystem do you use? Can you trust it? What happens if my app is allowed in the US but not in the UK or EU? This is the reason Bitcoin continues to outperform individual Altcoins. The situation is reminiscent of the early days of Open Source, when many well-meaning volunteers and developers realized their work was worthless once huge corporations took and monetized it. The new regulations will help developers address these concerns, but it will also mean that coins will have to rally on merit, not just speculation. And that will mean lower volatility.

3. The Death of the ‘Offshore Advantage’ and the Rise of Regulated Exchanges (i.e Coinbase and Kraken)

One of the biggest reasons crypto still has shady connotations is the existence of offshore exchanges that operate outside the reach of regulators. These platforms—Binance, OKX, Bybit, and others—have thrived in jurisdictions where compliance requirements are weak, allowing traders to dodge taxes, and move large sums of money without the scrutiny that traditional financial markets require. This has created a two-tiered system: regulated platforms like Coinbase and Kraken that play by the rules, and offshore giants that cater to traders who prefer a more lawless environment.

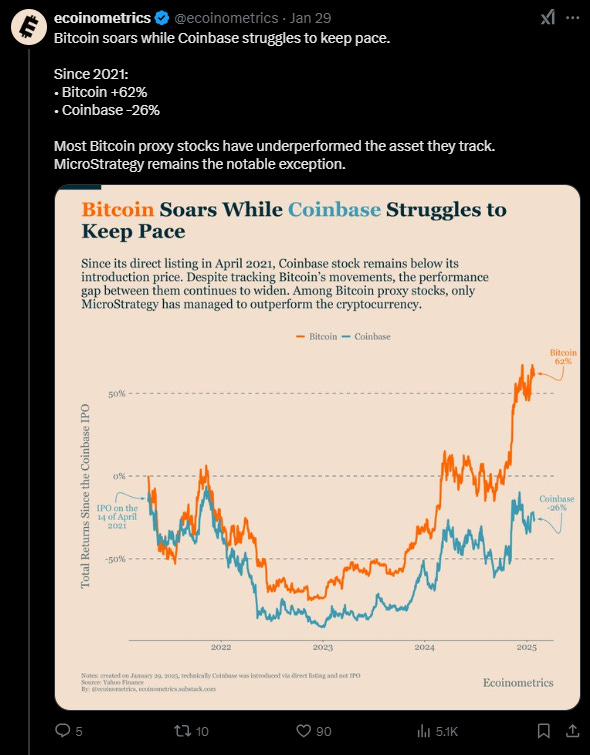

Regulation will end this advantage. If new regulations require all cryptocurrency exchanges to comply with strong AML (Anti-Money Laundering) and KYC (Know Your Customer) legislation, many of these offshore platforms may be forced to clean up their act or risk losing access to important markets such as the US and the EU. This would likely result in a large migration of traders from unregulated exchanges to those that comply with the law, concentrating more trading activity on platforms that regulators can oversee. While this may increase consumer safety and reduce the danger of big exchange collapses like FTX, it might also make crypto trading feel more like traditional finance—removing the 'wild west' appeal that has drawn many traders to crypto in the past. If this happens, it would be bullish for regulated platforms like Coinbase, which is currently underperforming Bitcoin as this chart by Ecoinometrics shows.

4. Institutional Adoption Increases as Barriers to Entry Fall

Regulatory uncertainty has been one of the most significant impediments to large institutional investors—pension funds, hedge funds, and asset mangers—entering the crypto market. Without clear laws governing how cryptocurrencies should be classified, taxed, and traded, most institutions have decided to remain on the sidelines rather than risk violating regulatory obligations. This is why, despite its scale, the crypto market continues to be dominated by retail investors and high-frequency trading businesses rather than long-term institutional capital.

Once a regulatory enironment is set, this will change. The recent legalization of Bitcoin ETFs has resulted in a massive inflow of capital, particularly from large institutions. Once institutions understand how to keep and trade crypto assets, they are more likely to allocate more capital to Bitcoin, Ethereum, and other large-cap cryptos that meet regulatory requirements. This could result in a more stable market over time, as institutional money is less sensitive to short-term excitement cycles. However, it also implies that cryptocurrency will become more like traditional financial markets, with increased monitoring, regulation, and a shift away from the decentralized ethos that originally distinguished the industry.

Institutional adoption also implies that crypto ETFs will become more popular, which would be positive for large-cap Altcoins. We have seen that Bitcoin rallies are fueled by regular inflows into the ETF. The same will happen with Altcoin ETFs.

5. DeFi Gets Squeezed—or Becomes the Underground Market

Decentralized Finance (DeFi) finds itself in a difficult regulatory situation. On the one side, DeFi platforms provide financial services like trading, lending, and staking without the need for traditional intermediaries like banks or brokers. However, new restrictions that force DeFi protocols to incorporate KYC procedures, limit leverage, or register as financial institutions may undermine the very premise of decentralization. This would most certainly force many DeFi platforms to either comply and become severely controlled, or to go underground, operating in ways that make them more difficult to monitor and govern.

The result could be a split in the DeFi space. Some projects, particularly those that want to work with institutions, will embrace regulation and portray themselves as "compliant" DeFi platforms, giving transparency and regulatory certification in exchange for more credibility. Others will resist, creating permissionless, decentralized alternatives that are more difficult to regulate. This could result in an increase in true peer-to-peer DeFi platforms that operate outside of standard legal structures, making them harder for authorities to shut down but also more difficult for the average user to access safely.

6. Privacy Coins and Censorship Resistance Come Under Fire

One of the easiest targets for regulators will be privacy-focused cryptocurrencies like Monero and Zcash. These coins allow users to transact anonymously, making them popular for people who value financial privacy but also a headache for law enforcement agencies trying to combat money laundering and illicit activity. With regulation tightening around the crypto space, expect governments to crack down hard on privacy coins, pushing exchanges to delist them and making it more difficult for users to access them legally.

Privacy-focused cryptocurrencies such as Monero and Zcash will be easy targets for regulators to go after. These coins allow users to deal anonymously, making them attractive to those who value financial privacy, but they also cause problems for law enforcement organizations attempting to combat money laundering and illegal activities. As regulations tighten in the crypto industry, expect governments to hammer down hard on privacy currencies, forcing exchanges to delist them and making it more difficult for users to access them lawfully.

7. The Rise of Government-Issued Digital Currencies (CBDCs)

One of the more concerning consequences of greater crypto regulation is the proliferation of Central Bank Digital Currencies (CBDCs). Some governments around the world have considered establishing their own digital currency, partly in response to the rise of cryptocurrencies, but few have done anything more than talk. CBDCs, unlike Bitcoin and Ethereum, which function on decentralized networks, would be entirely controlled by central banks, allowing governments unparalleled influence over how money is spent. Even if it doesn’t go this far, central banks may still require banks to hold some of their reserves in CBDCs.

CBDCs are likely to be marketed as "safe" alternatives to cryptocurrency, providing the benefits of digital payments without the volatility or regulatory uncertainty. However, they also have significant drawbacks, such as total transaction surveillance, the ability to freeze or restrict cash at any time, and the possibility of money expiration dates to regulate expenditure. CBDCs could allow governments more control over financial conduct than ever before in a future where cash is becoming increasingly scarce. While they will not completely replace Bitcoin or other decentralized crypto assets, they may make it more difficult for people to operate outside of the existing financial system, driving non-compliant crypto into underground markets.

8. Taxation and Capital Gains Rules Get Tougher

Regulation is more than simply keeping the cryptocurrency industry safer; it is also about governments ensuring they get their cut. Taxation is one one of the biggest concerns for regulators. Expect tax authorities to push for stronger reporting requirements for cryptocurrency transactions, such as requiring individuals and corporations to reveal their holdings, track capital gains, and report revenue from staking, lending, or mining.

This could signal the end of casual cryptocurrency trading as we know it. Many traders currently operate in a gray area, moving funds between wallets and exchanges without regard for tax ramifications. With new legislation, governments may force exchanges to report all transactions to tax authorities in real time, similar to how stock trading is already recorded. This would make it much tougher to 'forget' to record cryptocurrency gains, resulting in an increase in tax enforcement cases. While some traders will try to circumvent these regulations by using decentralized exchanges or privacy currencies, the crackdown on off-ramps (banks, payment processors, and exchanges) will make it increasingly impossible to cash out cryptocurrency gains without incurring tax penalties.

9. A Permanent Divide Between ‘Safe’ and ‘Shadow’ Crypto

When the dust settles, the cryptocurrency market will most certainly divide into two separate segments. On the one hand, you will have ‘safe’ cryptocurrency, such as Bitcoin, Ethereum, and regulated stablecoins, which are completely compliant with regulations and accessible through traditional financial institutions. These are the assets that institutional investors will adopt, and they are anticipated to develop steadily as cryptocurrency gets more integrated into the financial system.

On the other hand, there will be’shadow’ crypto—privacy currencies, offshore exchanges, and decentralized projects that refuse to comply with official regulations. These assets will be more difficult to obtain, riskier to own, and increasingly targeted by authorities. They will, however, be the final refuge of financial independence in a future where the majority of digital transactions are watched and controlled.

The funny part about all this is if it happens is that the crypto community that voted Trump in could see him ‘turn on them’ as some of them went in expecting massive deregulation, including things like no capital gains tax.